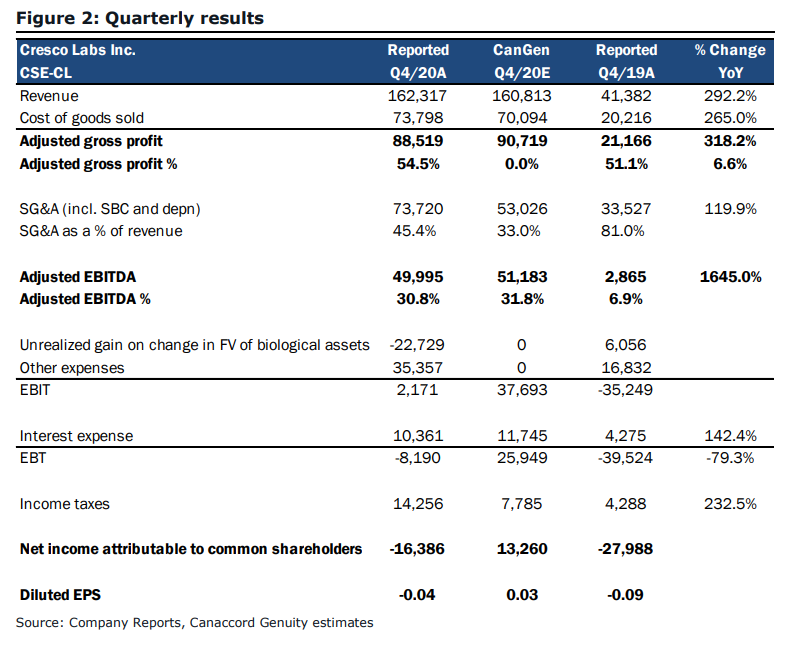

Last week, Cresco Labs (CSE: CL) reported their fourth quarter and full-year 2020 financial results. The company reported fourth quarter revenues of $162.3 million and adjusted EBITDA of $50 million. For the full year, they reported $476.3 million and adjusted EBITDA of $116 million.

Cresco Labs currently has 16 analysts covering the company with a weighted 12-month price target of C$22.70. Four analysts have strong buy ratings while eleven have buy ratings. One analyst has a hold rating on the company. The street high comes from Stifel-GMP with a C$34 price target, while Echelon Wealth has the lowest target at C$18.

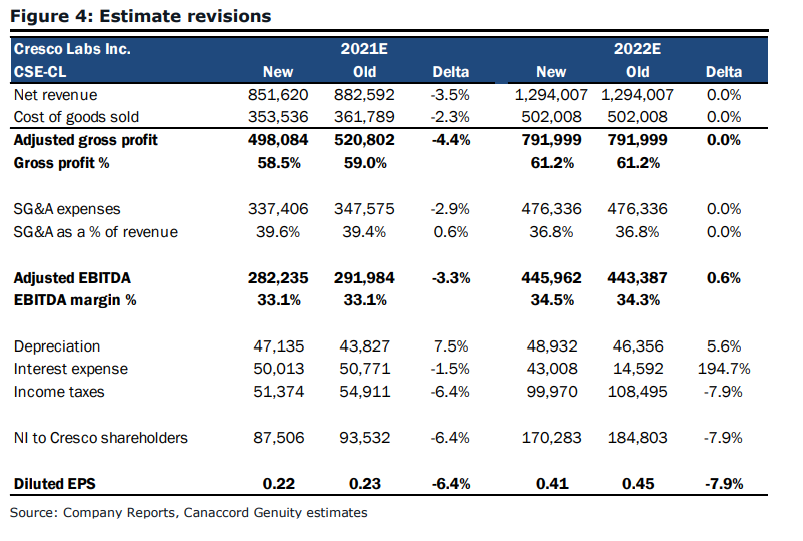

Canaccord Genuity’s analyst, Derek Dley, reiterated their speculative buy rating and C$22 12-month price target. He headlines, “Well positioned for continued growth across its operating footprint.” The main reason Dley reiterates their target is because he actually decreased Cresco Lab’s 2021 revenue and earnings estimates as seen below, despite Cresco beating prior estimates.

Cresco Labs’ came in slightly ahead of Canaccord’s full-year estimates. Dley says that this reflects a healthy quarter-over-quarter increase in their core markets and says that the company saw a 12% increase in its wholesale penetration quarter over quarter, to 929 dispensaries over nine states.

Dley reiterates management’s comments on the growth in 2021 due to cultivation expansion currently taking place in Michigan, Ohio, and Massachusetts. Dley writes, “we believe Cresco will see a material step up in its wholesale revenues in the state begin to take place in Q2/21, which when coupled with the above expansions, should help the company drive a 60% wholesale/40% retail revenue mix over the medium term.”

Onto the balance sheet and cash flow. The company reported $22 million in cash flow from operations and has $136 million in cash on hand. Dley says, “leaving it well positioned, in our view, to continue executing on its growth strategy across its core markets.”

Cantor Fitzgerald meanwhile increased their price target to $22.50 from $21 and reiterated their overweight rating on the name. Pablo Zuanic basically reiterates Dley’s analysis on the quarter, but writes this, “While we think it is early in the industry’s development to highlight product brand strength, management provided metrics that seem to imply the “house of brands” strategy is working. Thinking ahead to the advent of federal legalization, and interstate trade, we are trying to discern between what we deem “mom and pop” MSOs and those that are building an infrastructure that should withstand future major changes in the industry. In this sense, we think Cresco screens well.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.