E3 Lithium (TSXV: ETL) felt the need this morning to halt the trading of its equity momentarily following the pre-market release of preliminary results from its field pilot plant in Alberta.

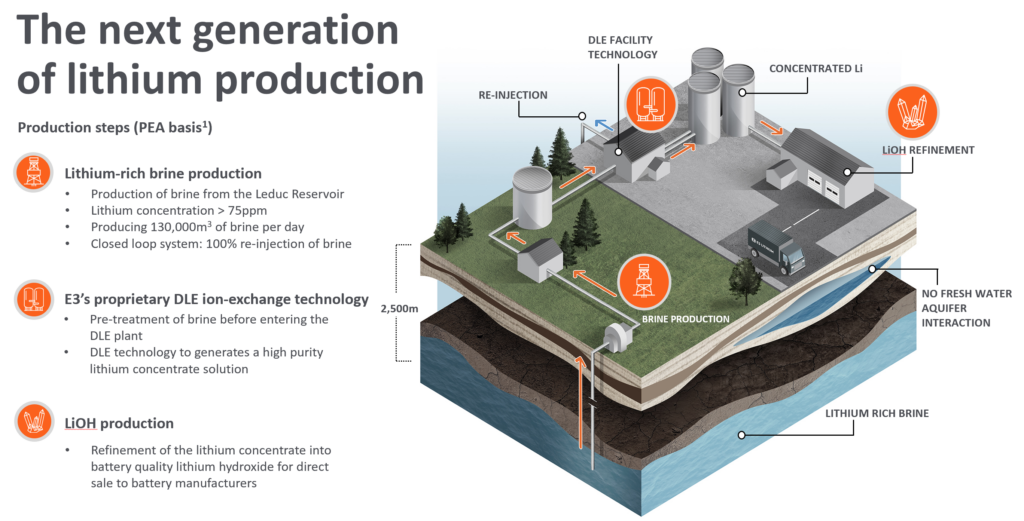

The firms pilot direct lithium extraction plant is currently conducting three predefined tests to determine the best operating conditions for the plant in a commercial environment. Once testing is complete, the ideal conditions will be selected for a longer test period ahead of a pre feasibility study and further engineering designs.

The first of three tests has reportedly been completed, with the company reporting that it experienced initial lithium recoveries of over 94%, with a purity of concentrate exceeding 80%. The average lithium grade within the concentrate meanwhile amounted to 884 mg/L.

“These results demonstrate an initial positive indication that the pilot is operating as expected. The E3 Lithium team is working hard to progress the pilot and is continuing to operate the pilot safely,” commented CEO Chris Doornbos.

Once the three predefined tests are completed, E3 plans to provide results against KPI’s that were outlined in June. The firms proprietary tech is reportedly being tested alongside two third party technologies.

E3 Lithium currently operates the Clearwater Lithium Project in Alberta, which boasts an after-tax NPV8% of US$0.8 billion, and measured and indicated resources of 16.0 million tonnes of lithium carbonate equivalent.

The equity is currently trading up $0.47, or 12%, following the release of the results to trade at $4.34 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.