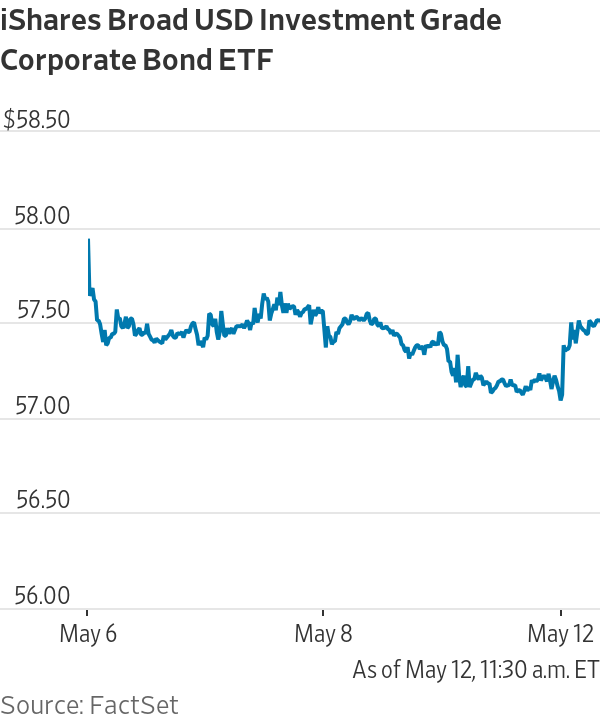

As a means of propping up the coronavirus-stricken US economy, the Federal Reserve introduced two credit facilities back in March that would be focused on the corporate debt market. The first facility would directly purchase bonds from issuers, whilst the other would be concentrated on buying the bonds on the open market – many of which have thus far been ETFs.

Speaking before the House Financial Services Committee on Capitol Hill, Fed chairman Jerome Powell stated that the central bank will now transition towards purchasing individual company debt instead of ETFs. According to Powell, the gradual transition towards individual bond buying would support market functioning as well as liquidity. Once companies are back on track and financial stressors are mitigated, the Fed will ease its monetary support – however, such a recovery could still be far away.

In addition, the Fed has also been met with some criticism regarding its corporate bond buying program. Some of the companies benefiting from the facility have been rated junk or speculative grade, and are thus exposing the Fed, and ultimately taxpayers, to an increased level of risk.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.