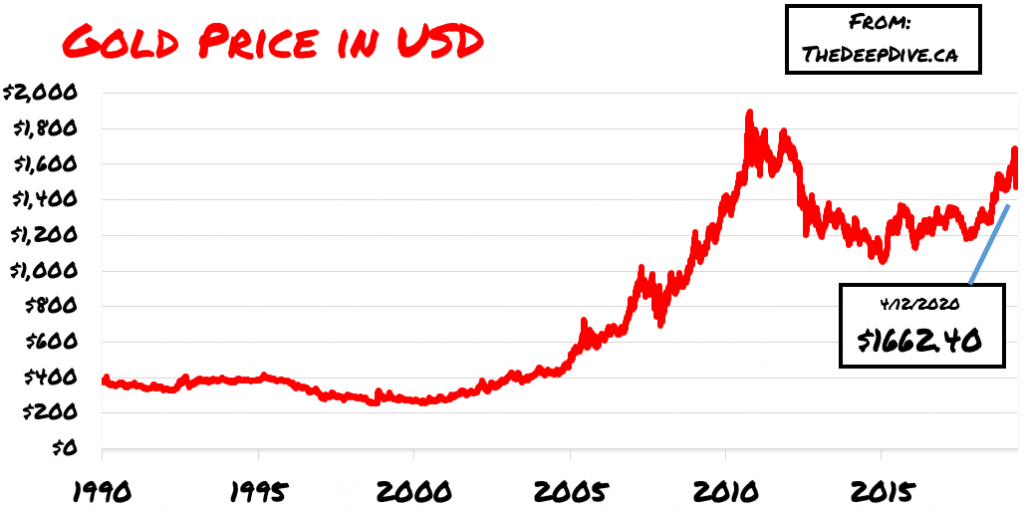

Pierre Lassonde, who is a well-known Canadian businessman and philanthropist, in addition to being a chairman of Franco Nevada, has made predictions on the future price of gold, suggesting it could go up to $20,000 within the next 2 to 5 years.

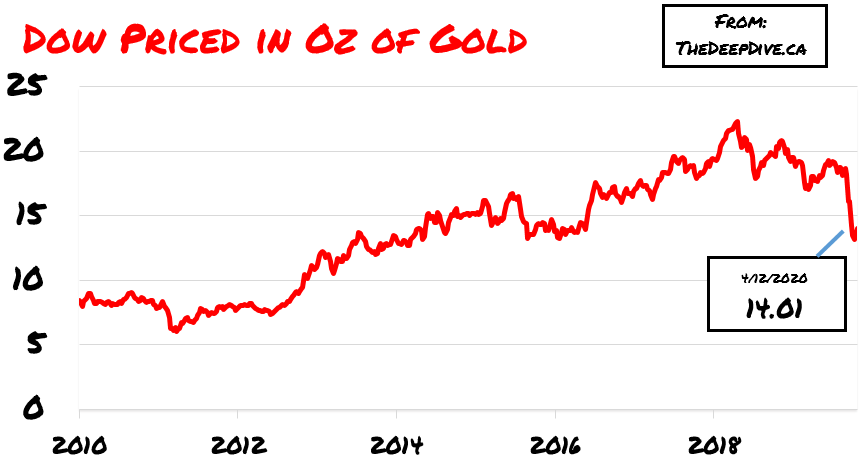

Given the current supply chain disruptions, he is anticipating that gold prices will only continue to rise, and will most likely mimic the Dow Jones Industrial Index within the next five years or so. “When I look at where we are today, the money creation will take time to [money] into people’s hands. I look at supply chain disruption, I think we’re looking at a two to five year period and I do believe that we will see, if not one to one [in the Dow/gold ratio], then very close to one to one,” Lassonde told Kitco News.

He also speculates that the Dow to Gold ratio of one-to-one is a high probability. Pierre is basing the assumption on historical periods, where such a ratio between the Dow Index and gold prices has been evident. Something we haven’t seen in the last decade:

Pierre also mentioned that since gold mining stocks are in the preliminary stages of a bullish market, it will take awhile for gold equities to catch up- but when they do, there are going to be compounded significantly. Thus, he forecasts a bright future for gold miners.

Information for this briefing was found via Kitco. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

When is the time to go all in on gold SmallCap?

Gold going to $20k?

I will take $2k. Lets start with that, ok?

Hermin Paul with $20,000 call?

Hermina didn’t make the call. Read a little closer Ralph.