If the coronavirus infection rates do not subside soon, resulting in a reinstatement of economic lockdowns or even increased trade tensions, stock and risky asset markets could falter once again, warns the International Monetary Fund (IMF).

When the severity of the coronavirus pandemic first became evident, it caused many countries to impose some forms of economic lockdowns and social distancing measures. As a result, equity markets took a beating, with the S&P falling by a total of 34% over a duration of 23 trading days. As a result, financial aid from the Federal Reserve pulled the market back to stability relatively quickly. However, the IMF warns in its report that a certain disconnect has developed between actual economic prospects and financial markets.

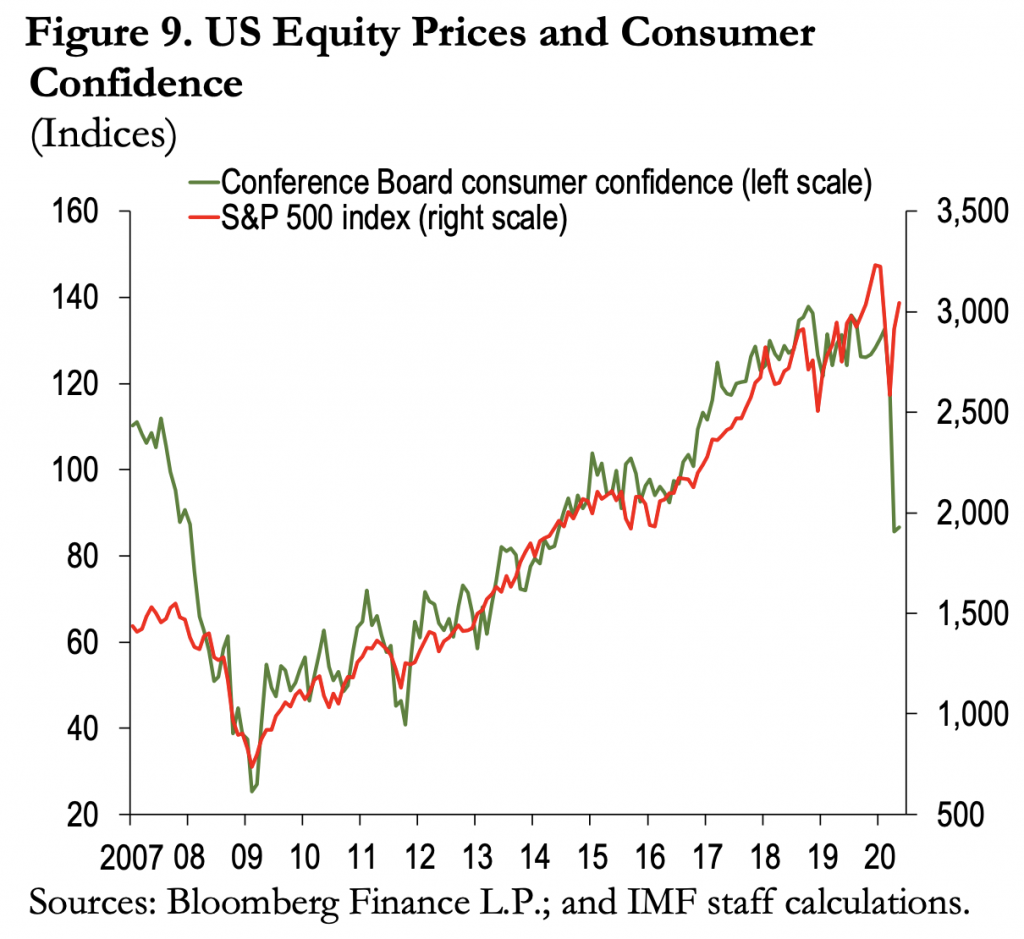

In light of the extensive financial support by central banks, equity markets have been expecting a V-shaped economy; however, that is not the case. a divergence has emerged between economic prospects and the price of risk in the financial market. Although equity markets have been faring well as a result of unwavering central bank support, consumer confidence on the other hand has been significantly dwindling. Therefore, such a situation raises the question of whether or not equity markets would be able to survive once central bank support ceases.

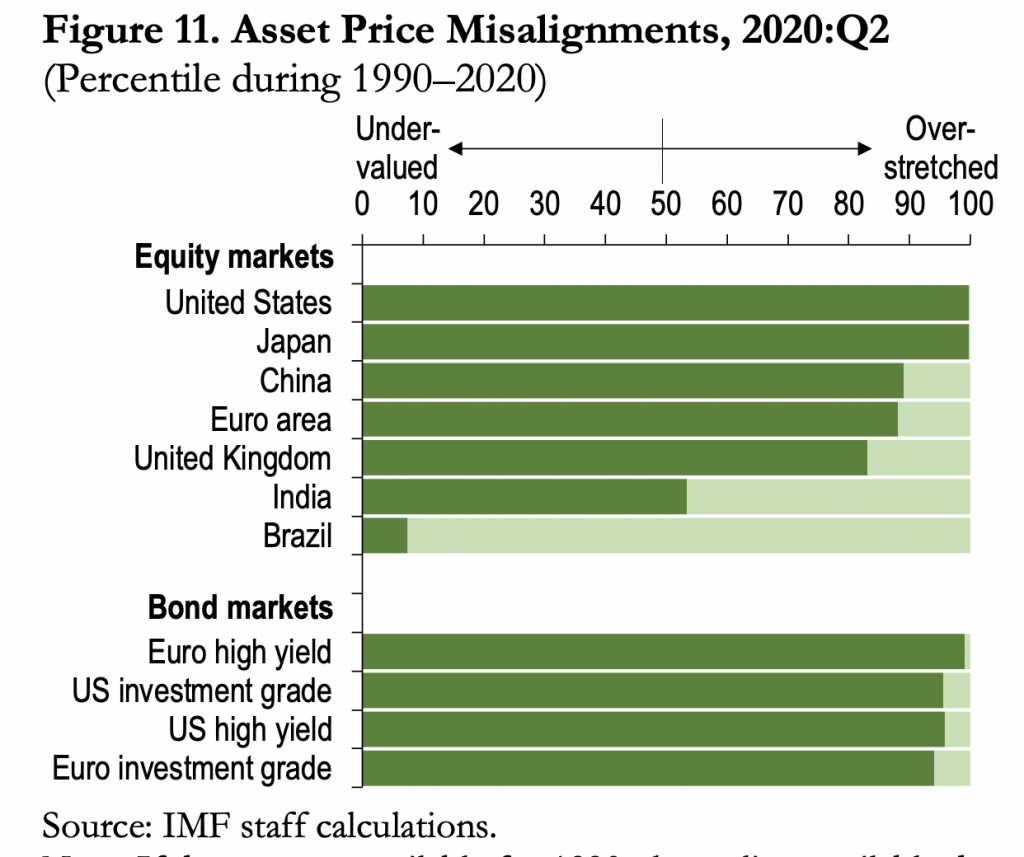

The IMF further warns that a significant gap exists between market valuations and market prices. In the event of an economic trigger such as a resurgence of the coronavirus, the reinstatement of containment measures, or a prolonged and more severe recession, the repricing of risk assets could very well ensue.

Information for this briefing was found via the International Monetary Fund and Kitco. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.