On January 24th, K92 Mining Inc. (TSX: KNT) announced their 2022 operational guidance, wherein the company said it expects to produce 115,000 to 140,000 gold equivalent ounces in 2022, with a cash cost of $560 to $640 per ounce and an all-in sustaining cost of $890 to $970 per ounce. They also expect to spend $41 to $47 million on growth and an additional $12 to $15 million on exploration.

K92 Mining currently has 12 analysts covering the stock with an average 12-month price target of C$11.60, or a 70% upside to the current stock price. Out of the 12 analysts, 3 have strong buy ratings and the other 9 have buy ratings. The street high sits at C$13 or a 90% upside, while the lowest 12-month price target comes in at C$8.75.

In BMO Capital Markets’ note, they reiterate their outperform rating and C$11 12-month price target, saying that the production numbers basically came in line with their estimates with Kainantu being the main driver of growth.

The companies guidance came in 34% above 2021’s production, but slightly below BMO’s 149,000-ounce estimate. They add that this guidance, “sets the stage for production to increase over 2021.” 2022 will have a full year of mining at Judd with the Stage 2A expansion expected closer to the end of 2022.

BMO says that this year’s focus is growth, with Kainantu focused on increasing their production, mining starting at Judd in the fourth quarter of 2021 and Stage 2A coming online at the end of this year.

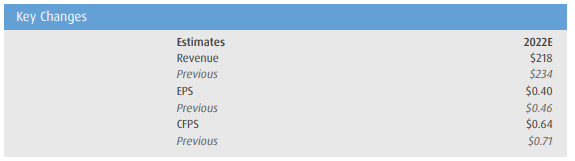

Lastly, you can see BMO’s updated 222 estimates, which have been updated to incorporate K92’s guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.