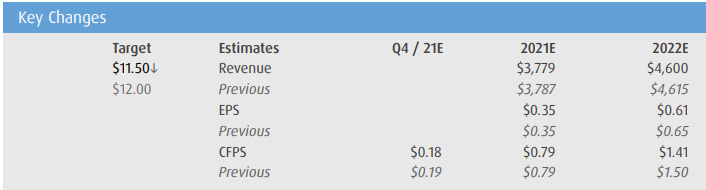

On January 21st, BMO resumed coverage on Kinross Gold (TSX: K) after its acquisition of Great Bear Resources (TSXV: GBR), they call the deal accretive to Kinross. They had valued Great Bear Resources at US$2.1 billion versus the US$1.4 billion purchase price. BMO reiterated their outperform rating but lowered their 12-month price target to C$11.50 from C$12.

Kinross Gold currently has 13 analysts covering the stock with an average 12-month price target of C$12.64, or a 78% upside to the current stock price. Out of the 13 analysts, 3 have strong buy ratings, 9 have buys and 1 analyst has a hold rating on the stock. The street high sits at C$17.50, representing a 146% upside while the lowest price target comes in at C$8.

BMO says that Kinross is getting a great asset in the Dixie project, helping the company hit its 2.5 million GEO per year production target. Great Bear Resources originally was planning on an initial resource estimate early in 2022 with a PEA coming later this year. Now, Kinross has said the focus has shifted to infill drilling during 2022, then a resource and scoping study in late 2022 with production coming in late 2029.

They add that the deal makes perfect sense as the project, “fits well into Kinross’ project pipeline.” They say that Kinross has one of the deepest pipelines in their coverage, which is good for Kinross since they are now not pressured to rush into Dixie.

Based on what Kinross has provided BMO, they have elected to not change any of their estimates, though they say that they value the acquisition at US$2.1 billion, partly based on Kinross’ existing tax loss pools. They expect that development will last from 2022 to 2027, with construction starting in late 2027 and lasting till 2023, production to start in late 2029.

They expect 8.5 million ounces of minable resources with a development cost of under US$1 billion. Lastly, they expect the all-in sustaining cost to be between US$600 and US$800 per ounce, with it being closer to the higher end of the range during the first two years of operation.

Below you can see BMO’s updated full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.