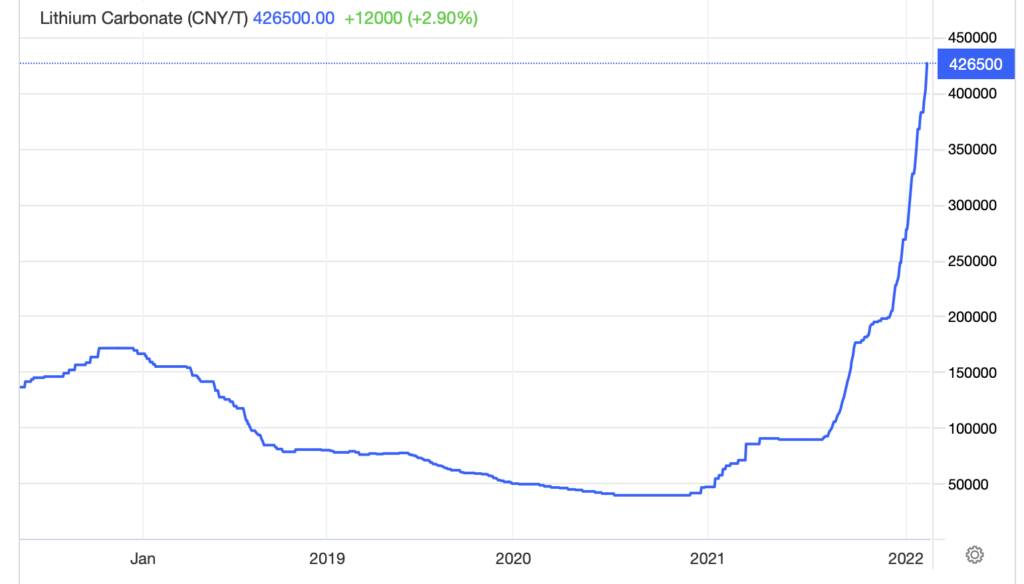

The price of lithium, one of the most critical and indispensable elements in electric vehicle (EV) batteries, continues to soar. Reflecting what appears to be nearly unlimited demand for the silvery-white metal, lithium’s price graph looks more like a vertical line each day. Lithium carbonate prices are up around 50% in just the first seven weeks of 2022, and around 750% in the last 13 months.

Two lithium producers reported 4Q 2021 earnings in the last few days — Albemarle Corporation (NYSE: ALB) and Livent Corporation (NYSE: LTHM). Each signaled that the upward trajectory of future lithium prices should continue.

Specifically, Albemarle, which operates lithium projects on a global basis, including in Argentina and Chile, expects its average realized lithium prices to soar 40%-45% in 2022 based on tight market conditions and variable pricing features in its contracts. Livent, which has key projects in the U.S. state of North Carolina and in Argentina, reported that it continues “to realize significantly higher prices across” its portfolio.

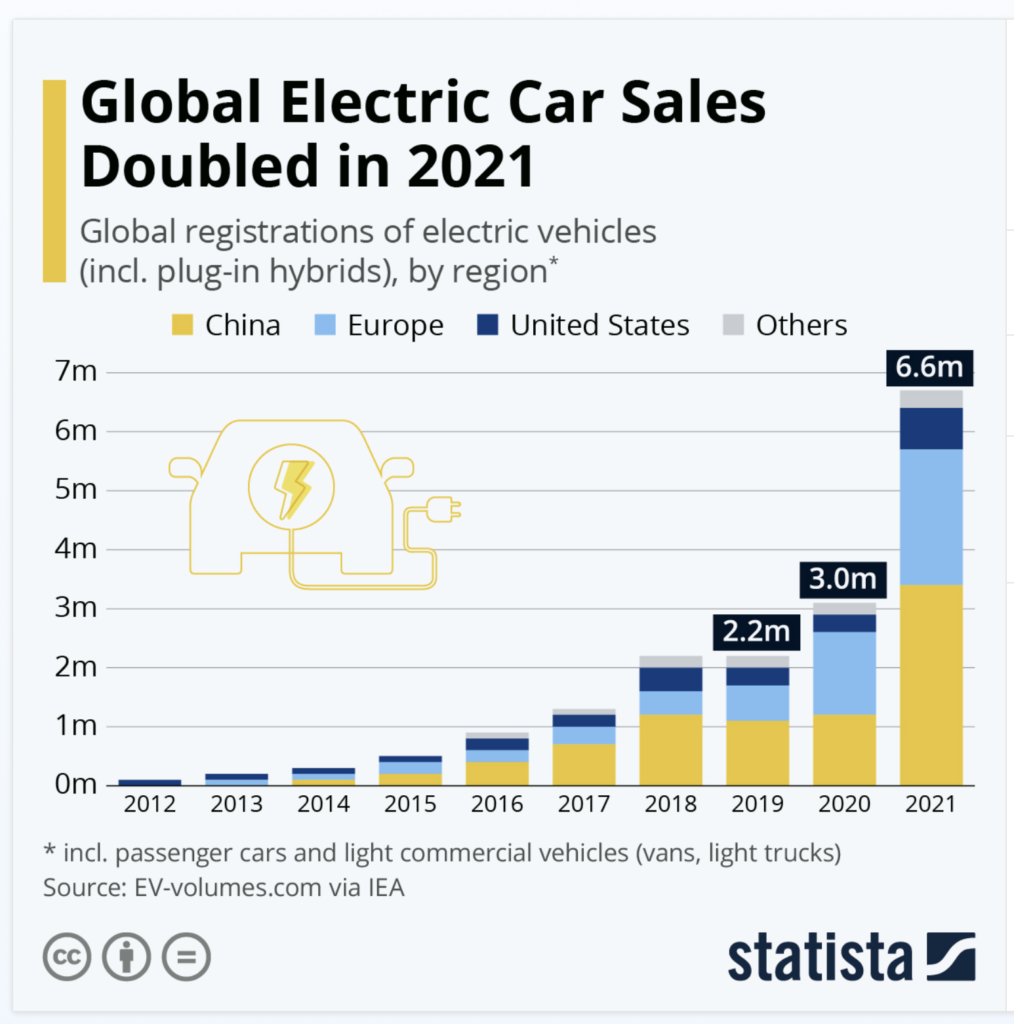

Adamas Intelligence reports that lithium carbonate equivalent (LCE) deliveries to EV battery makers increased a remarkable 31% in January 2022 from December 2021. This pace represents a step-up from the overall 2021 rate when global EV unit sales increased about 120%. In December 2021 alone, the China Passenger Car Association reports that 505,000 EVs were sold in that country.

Automakers are increasingly embracing lithium iron phosphate (LFP) battery compositions for both environmental and economic reasons, as these batteries contain neither the toxic and expensive element cobalt nor expensive nickel. Nevertheless, lithium remains a constant in virtually all battery designs.

Tesla (NASDAQ: TSLA) has changed its batteries in standard range vehicles to an LFP chemistry. The EV giant continues to use nickel and cobalt in batteries of longer-range vehicles, as LFP batteries are less energy dense than other designs.

According to S&P Global Market Intelligence, the supply of LCE is expected to be about 636,000 tonnes in 2022. However, demand is expected to exceed supply by around 4% to 9%, per a range of analysts’ estimates. More alarming, Benchmark Mineral Intelligence thinks that LCE demand could exceed supply by an aggregate 300,000 tonnes over the next nine years or so.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.