Leading the market today in volume is that of QYOU Media (TSXV: QYOU), the focus of today’s market movers. The company has traded over 18.3 million shares on the TSX Venture as of the time of writing, along with well over 13.9 million shares on the alternate markets, resulting in combined volume in excess of 32.2 million.

Today’s volume is notable for the company, with the trading leading to a current 33% gain with the equity up $0.055 to that of $0.22, after hitting a 52 week high of $0.235 earlier in the session. The action is a notable achievement for the firm, given that the thirty day average volume currently sits at 1.9 million.

The cause for all the action appears to be in connection to yesterdays announcement that the firm has achieved monetization for its flagship The Q India channel in India, a key event for a company that has spent years developing out its flagship operation. The company is focused on the media and entertainment space, providing content to youths and young adults in India, one of the largest demographics in the nation.

The time and effort put into the company by its founders, which include the well-known capital markets aficionado G. Scott Paterson, formerly of Yorkton Securities, as well Curt Marvis, an original MTV executive whom then went on to serve as an exec at Lionsgate Entertainment, has now seemingly paid off. The company has as of late achieved notable viewership, becoming one of the most watched channels within its target market across all of India.

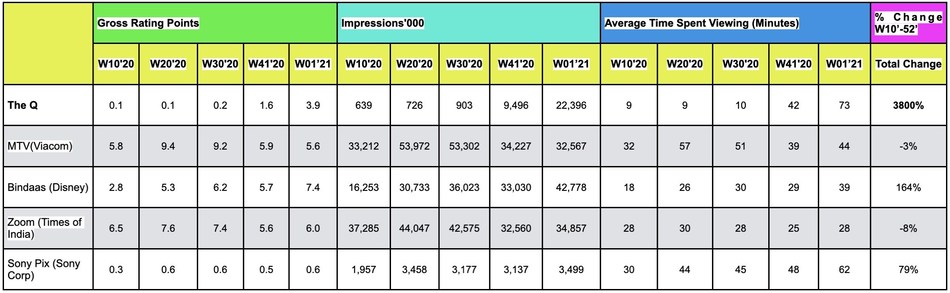

The company was first rated by BARC, the Broadcast Audience Research Council whom is effectively the “Nielsen of India”, in the first months of 2020, wherein it barely registered on the ratings. In the time since, The Q India has become the fast-growing Hindi language channel in the country on both satellite and cable television, soaring past its peers in terms of average time spent viewing – a figure which sits at 73 minutes per session. Comparatively, its next closest peer is that of Sony Pix, whom sits at 62 minutes per session, followed by MTV at 44 minutes.

Impressions at the same time have been growing significantly, with the company one year ago seeing 639,000 impressions within the course of a week, to now having 22,396,000 impressions per week, while steadily taking market share from peers. This can be evidenced in the chart above, where MTV has seen significant declines while The Q has demonstrated a solid rise.

Notably, these ratings are only for cable and satellite television, and doesn’t include the wide distribution that the company has on a number of apps. One such example is that of the Chingra App, India’s version of TikTok. The platform, which consists of over 45 million users in India and contains the same target audience, has an average daily user engagement time of an astounding 59 minutes, and an average of nearly 100 million videos viewed each day – providing an ample growth opportunity for The Q as well.

In terms of yesterday’s announcement specifically, the company has seen initial orders for the first two weeks of January of $200,000 – a notable achievement for a firm whom in its most recent quarter recognized revenue of $390,950. If this run rate is about to stick around for the entire quarter, the firm could see an explosion in terms of quarterly revenue growth. The initial orders came from leading brands in India, including Airtel, SBS Biotech, Reckitt Benkiser and Britannia, demonstrating the perceived quality of the firms viewership within the country.

While $200,000 in initial orders have come through, the company also specifically stated, “additional new campaigns are expected to launch throughout the quarter,” thereby providing a potential path to significant growth on a quarterly basis. While the company may have been operating its now flagship channel in India for three years, it appears that now the company is -finally- just getting started.

FULL DISCLOSURE: QYOU Media is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover QYOU Media on The Deep Dive, with The Deep Dive having full editorial control. Additionally, the author personally holds shares of the company. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.