On December 7th, Medmen Enterprises’ (CSE: MMEN) reported first-quarter fiscal 2021 financial results. Medmen reported revenues of $35.6 million, up 31% quarter over quarter. Gross margins improved to 47% from 40% while the company reduced total SG&A and corporate SG&A by 21% and 29% sequentially.

Medmen currently has five analysts covering the company with a weighted 12-month price target of C$0.23. This is slightly down from the average at the start of October, which was C$0.46. Three analysts have hold ratings. One analyst has a sell, and the other analyst has a strong sell rating.

Matt Bottomley, Canaccord’s cannabis analyst, currently has a C$0 price target and a sell rating on Medmen. He headlined “FQ1/21 review: Progress from a rough FQ4/20 but capital position remains significantly challenged,” in his note sent to investors on December 8th.

He says that the results were in line with management’s outlook and that the company is making incremental progress towards stabilizing its operations. “The company continues to operate with a cash balance that is still razor thin compared to its potential capital needs with the prospect of future material dilution still a very real risk for the company.”

Bottomley says that although Medmen reported revenues up 31% sequentially, they are still 22% below fiscal third-quarter 2020 levels. He attributes the increase to a rebound in California, Medmen’s core market, which is up 34% quarter over quarter. Nevada sales were up almost three times quarter over quarter due to forced retail shutdowns.

Bottomley highlights that Medmen needs additional capital and says that this is a material headwind. He says that although Medmen has $10 million of cash on hand, “we believe MedMen continues to operate with a much less than ideal capital position. We note that the company has since made efforts to secure an additional ~US$26M of financing commitments while receiving a further US$10M though the sale of its Evanston, IL retail dispensary.”

He then says that the path to profitability is still uncertain and that Medmen has more than $500 million of lease liabilities, notes payable, and convertible debt on their balance sheet. Finally, he states that Medmen will likely end up having to tap the equity markets and dilute current shareholders.

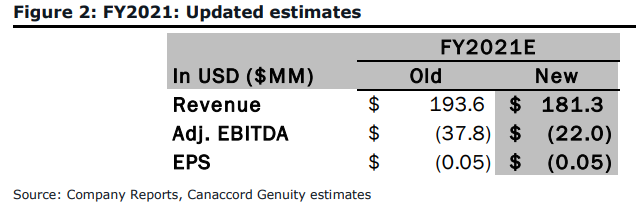

Below you can see the new fiscal year 2021 estimates, which are slightly down from the previous forecast. Bottomley says that he is lowering the fiscal year 2021 estimate due to an uptick in COVID-19 cases and new lockdown measures implemented.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.