With inflation running at 40 year-highs, consumers face a tough road ahead. But, according to economists, the Bank of Canada is not backing down on its fight to bring price growth to the 2% target rate, and will likely deliver another colossal rate hike come its next policy decision this week.

Bay Street economists are expecting the central bank will likely raise borrowing costs by another 75 basis points on September 7, bringing the overnight rate to 3.25%, falling into the restrictive section where economic activity becomes subdued. Some economists foresee a smaller increase in borrowing costs to the tune of 50 basis points, while others are expecting another full percentage point move upwards.

Since the beginning of March, the Bank of Canada has raised interest rates four times, vowing to combat the record-high increase in consumer prices and maintain Canadians’ confidence in monetary policy. In fact, RBC economists Nathan Janzen and Claire Fan are taking the central bank’s hawkish approach seriously, alluding to a rate hike even higher than July’s one percentage point. “The bank’s commitment to front loading rate hikes in the face of red-hot inflation means an even bigger 100 bps increase … can’t be ruled out.”

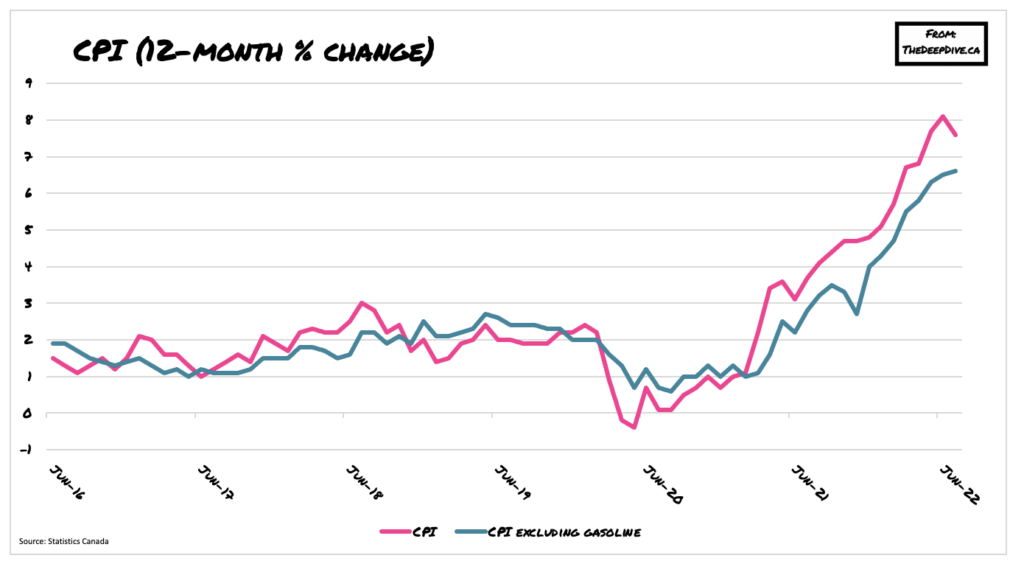

Although it typically takes about six to eight quarters for an interest rate increase to have a substantial impact on the economy, Governor Tiff Macklem’s expedited campaign to reverse the central bank’s incorrect forecast on the transience of inflation is already sending ripple effects throughout the economy. Statistics Canada data suggests inflation may have already peaked, with the country’s real estate market rapidly losing momentum in wake of rising mortgage costs. But, despite signals of a softening economy, the Bank of Canada will likely not wane from its course.

The CPI still remains four times higher than the central bank’s 2% target range, and policy makers fear that such high inflation will become entrenched should employees begin to demand higher compensation and businesses set higher prices in response. “By acting forcefully in raising interest rates now, we are trying to avoid the need for even higher interest rates and a sharper slowing down the road,” Macklem said in an interview back in August. “We know our job is not done yet— it won’t be done until inflation gets back to the 2-per-cent target.”

However, some major Canadian banking institutions believe the Bank of Canada’s rate hikes will send the economy into a recession as early as next year. Although Macklem still insists the bank is of capable of engineering a “soft landing,” he acknowledged that unemployment will likely increase and the economy will contract in wake of substantially higher borrowing costs. But, with another rate increase certainly en route on Wednesday, speculation has shifted to what policy makers will do afterwards.

“While we’ve argued October’s meeting could result in a hold, we do not expect the BoC to fully close the door to future rate hikes in the statement,” said National Bank director of economics and strategy Taylor Schleich. “It’s more likely the bank strikes a decidedly more data dependent tone. And assuming the BoC doesn’t explicitly rule out further rate increases, we also wouldn’t be surprised to see them take a page out of the Fed’s book and guide us towards a slower pace of hikes.”

Information for this briefing was found via Bloomberg and twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.