On Monday New Gold (TSX: NGD) reported its second quarter production results. The company produced 52,431 ounces of gold and 7.4 million pounds of copper, bringing the company’s total gold equivalent ounces produced for the quarter to 70,514. During the quarter, the company sold 51,223 ounces of gold and 4.4 million pounds of copper.

The company said that during the quarter, operations at the Rainy River Mine, “were adversely impacted by heavy rainfall and flooding around the Fort Frances area in northwestern Ontario.” Which translated into a lower total tonnage mined and has caused the company to change their plan for the mine, in which they will be processing lower grade ore for the second half of 2022.

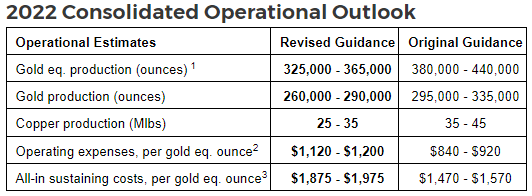

New Gold is now guiding that the Rainy River Mine will produce between 230,000 and 250,000 ounces of gold in 2022, down from 265,000 and 295,000 ounces. Additionally, they add that due to “lower gold production, as well as, current inflationary cost pressures,” operating expenses per gold ounce is now between $960 and $1,040 versus their prior guidance of being between $730 and $810. The all-in sustaining costs have also increased significantly, which is expected to be between $1,620 and $1,720, versus prior guidance of between $1,270 and $1,370.

The issues do not stop there for New Gold. The company said that New Afton had an earlier than planned shutdown and will now be using lower grade stockpiles to continue the mill feed. As a result, the company is lowering their copper guidance from the mine to be between 25 and 35 million pounds, revised from 35 to 45 million.

Below you can see the new consolidated operational outlook provided by the company.

There are currently 11 analysts covering New Gold with an average 12-month price target of C$1.83, or an upside of 100%. Out of the 11 analysts, 1 has a strong buy rating, 2 have buy ratings, 7 analysts have hold ratings and 1 analyst has a sell rating on the stock. The street high price target sits at C$3, which presents a 225% upside to the current stock price.

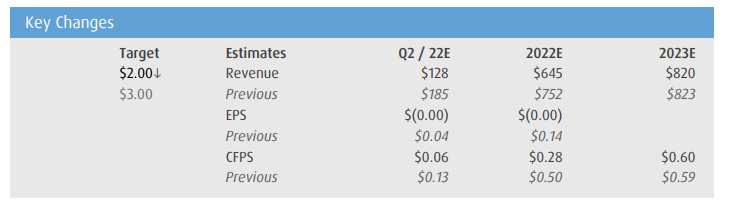

In BMO Capital Markets’ note on the results, they reiterate their outperform rating but lower their 12-month price target to C$2.00 from C$3.00, saying that the company’s production results came in below their estimates, and that the downwards guidance revision mixed with costs rising warrant the price target cut.

On the production results, BMO was expecting New Gold to report gold production of 76,100 ounces and 9.8 million pounds of copper for a total equivalent ounce production of 102,900 ounces. This puts the 70,514 actual, missing their estimates by almost 32%.

Though BMO does not provide any commentary on the company’s issues at both Rainy River and New Afton, they have lowered their estimates to reflect the challenges and new production and cost guidance, which you can find below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.