The price of oil has continued to rise as demand around the world is perceived to increase heading into the summer months. West Texas Intermediate crossed the $30 per barrel mark in overnight futures trading today, and is currently pushing a high of $33.06 per barrel. The push is amid a Bloomberg report that Chinese demand levels have returned to pre-pandemic levels.

Oil demand from China was stated to be approximately 13 million barrels per day, as per several unnamed executives and oil traders. Increased oil use from China is stated to be a result of the country emerging from the pandemic with an interest in avoiding public transportation. Pre-pandemic levels saw oil consumption of 13.4 million barrels a day in March 2019, and 13.7 million barrels a day in December 2019. Current levels don’t factor in jet fuel use however due to global restrictions, which would have pushed current levels higher.

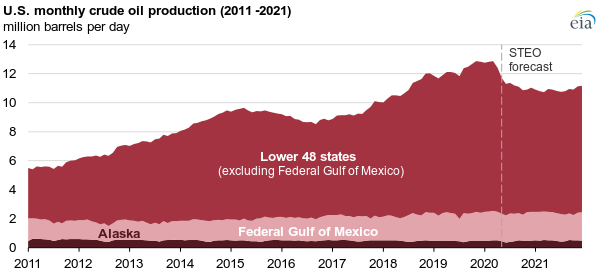

The increasing demand comes as producers are pulling back on production globally. In the US, active drill rigs in the lower 48 states fell dramatically from 753 rigs to 355 rigs as of May 8, 2020, with production estimated to fall even further going into 2021.

Despite the claims made by unnamed sources to Bloomberg, ZeroHedge reported this morning that over 100 million Chinese residents remain in lockdown in northeast China. This was further confirmed via a tweet by Bloomberg itself, wherein it indicated that 108 million Chinese are currently on lockdown, which doesn’t exactly jive with their report that Chinese oil consumption has returned to pre-pandemic levels.

Some 108 million people in China’s northeast region are being thrown back under lockdown as a new cluster of #coronavirus infections emerges.

— Bloomberg QuickTake (@QuickTake) May 18, 2020

More @business: https://t.co/BK01JErhCY #Covid_19 pic.twitter.com/NxkC12nJ9c

The upward push to the price of oil also does not appear to take into consideration the current state of oil capacity globally. Just last week, the Commodity Futures Trading Commission (CFTC) warned of possible negative oil heading into this week as the June contract is scheduled to settle.

Information for this briefing was found via ZeroHedge, CME Group, TradingView and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.