In response to Binance’s attempt to dismiss a lawsuit filed by the U.S. Securities and Exchange Commission (SEC), the regulatory body has asserted that the dismissal plea lacks legal merit.

The SEC, in a filing on Wednesday, countered Binance’s motion, claiming that the exchange’s defense is based on misinterpretations of the law, which could undermine established legal precedents crucial to the nation’s securities laws. The SEC argues that Binance’s approach proposes a rigid framework that is incompatible with the existing legal system.

“Lacking support in the law, Defendants resort to inapt analogies, comparing the assets sold on their platforms to supermarket items like oranges. These comparisons are absurd,” the SEC said.

In essence, the SEC asserted that investors using the defendants’ platforms were not presented with “oranges or baseball cards;” instead, they were extended the chance to engage in the promoters’ endeavors. This involvement was framed through the potential appreciation of crypto asset value, aligning with the promoters’ initiatives to advance and expand the issuers’ blockchain-based business. This parallels the scenario in the Howey case, where the defendant allured investors with the promise of profits through investment in the cultivation of “orange groves.”

“If oranges alone were at issue, those selling and promoting these assets and Defendants themselves would have had no need to entice investors with extended marketing campaigns touting their potential to increase in value based upon the efforts of others,” the agency added.

The SEC’s allegations focus on Binance’s launch of the BNB token and Binance USD, which the agency deems as violations of securities law. Additionally, the SEC contends that the company’s staking and earning programs constitute securities violations. Moreover, the SEC disputes Binance’s reliance on the “Major Questions Doctrine,” a principle increasingly invoked by crypto firms in legal defenses.

Binance, along with its U.S. arm and founder Changpeng Zhao, has argued that the SEC’s lawsuit represents an overreach of its regulatory mandate. They insist that the agency must demonstrate how their actions violate securities laws. However, the SEC firmly rejects this notion, emphasizing its duty to enforce the legal frameworks set by Congress.

“But here we are.” pic.twitter.com/8fxjB0whhA

— Patrick McKenzie (@patio11) November 8, 2023

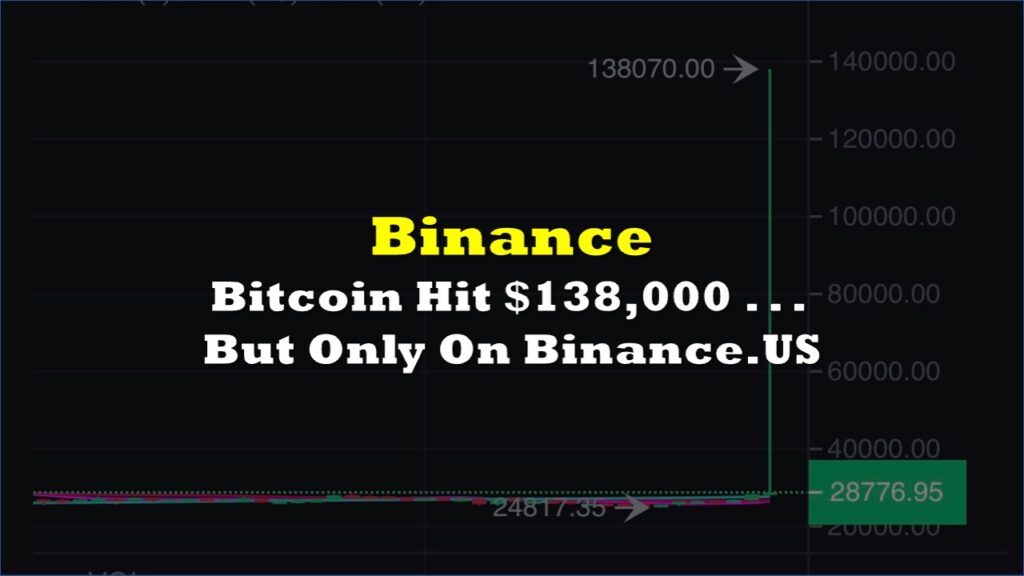

Moreover, Sigma Chain, an entity which the SEC claimed is owned and controlled by Zhao, was allegedly involved in strategically timed wash trading on the Binance.US Platform. This practice artificially inflated the platform’s trading volumes at crucial strategic junctures, according to the regulatory body.

For instance, on April 6, 2022, when the Binance.US Platform introduced COTI, a crypto asset security, for trading, Sigma Chain’s wash trades accounted for as much as 35.52% of COTI’s daily trading volume in the subsequent days, the SEC noted.

Oh look, you know that wash trading that Bitfinex'ed has been warning everyone about in crypto?

— Bitfinex'ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) November 8, 2023

It turns out that CZ was in fact wash trading on Binance, while also calling out exchanges for faking their volumes.

CZ was projecting at the highest levels.

Binance is a fraud. pic.twitter.com/TO1wbQ0Crn

This legal dispute occurs amid the SEC’s ongoing scrutiny of the cryptocurrency industry. While Binance’s defense challenges the SEC’s interpretation of their activities as violations, the SEC maintains its position of applying traditional securities law in the cryptocurrency sector.

Information for this story was found via Coindesk, Coingape, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.