SNDL is a NASDAQ-listed stock, printed by the treasury of a company (Sundial Growers) that runs an objectively terrible cannabis business, that is currently outperforming its peers as it puts on an absolute clinic in the capital markets. SNDL shareholders saw a 78% jump in share price Wednesday, as the stock closed up $1.30 at $2.95, much to the delight of The Deep Dive’s own Smallcap Steve, who faded his own instinct to climb aboard Sundial in a Costanza call and, as far as we know, is still on the roller coaster. (Tune in to Smallcap Steve Live for updates).

SNDL the stock was listed publicly on the NASDAQ in August of 2018 with all the timing of a parka sale in a heat wave and tracked the general decline of public cannabis equities. The business that issues it, Sundial Growers (NASDAQ:SNDL), struggled right away, posting quarter after quarter of declining revenue.

By November of 2019, the company was carrying a debt total larger than its market cap. By January 2020, SNDL had cancelled its construction plans and international deals, and become the poster child for the abject failure of corporate cannabis as its CEO and COO resigned abruptly.

The company has posted widening gross losses the last three quarters running and, despite an aggressive marketing effort, hasn’t yet won the hearts of consumers. The company’s own estimates put it at a 3.3% share of the hyper-competitive national market in Q3 2020, despite being in all of the major markets, down from a 4.7% share in Q2 2020.

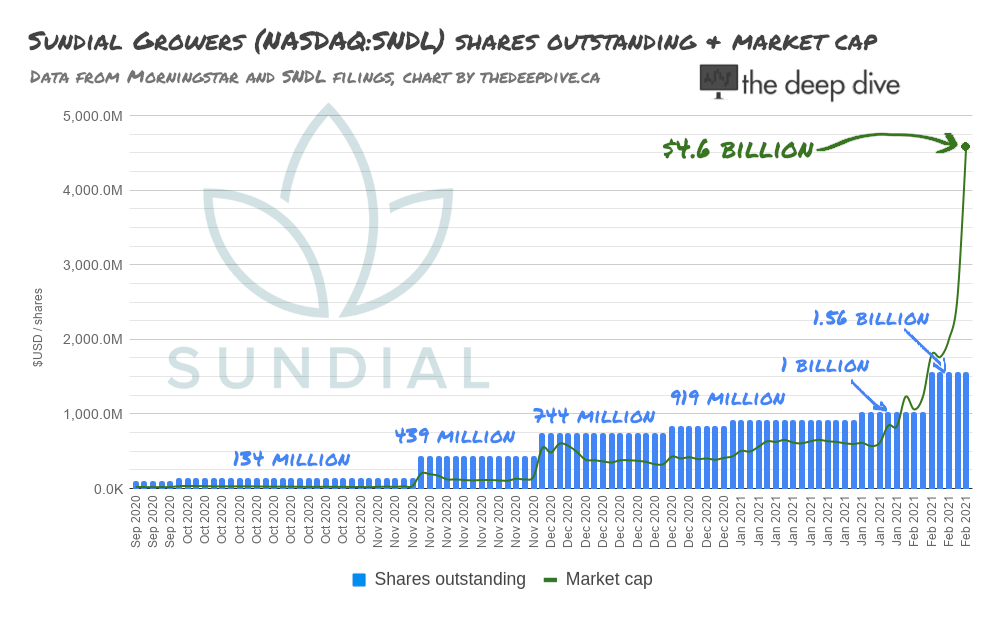

SNDL bounced along the bottom for most of 2020, largely left out of the great COVID market rally with other cannabis stocks, but the volume began to pick up in November of 2020 and, as soon as it did, this SNDL team got to work putting to rest its biggest (literal) liability.

It did a massive deal at the end of November to get its convertible debt converted below the strike price. Then, with the stock trading at $0.66, filed on December 4th for a $200 million shelf registration and a $150 million at the market offering at the same time.

SNDL treasury go brrrrrrrrr….

By December 15th, SNDL had sold enough stock out of its treasury to pay off $50 million of the principle on its long-term debt. Less than a week later on December 21st, it had paid off all $277 million of it.

If the market cared about the ballooning of SNDL’s cap table, it didn’t show. SNDL has averaged 435 million shares of daily volume in calendar 2021, as it maxed out is offerings and announced some more.

Meanwhile, in Yaletown…

Zenabis Global (TSX.V:ZENA) spent the great Cannabis Equities Depression of 2020 dialing its operational efficiency up to a respectable state of production and growth.

Zenabis’ improvement had been a debt-financed affair that left it owing $58 million at 14% on a note that it had to give up a royalty on its cannabis revenue to close.

Suddenly unencumbered by debt, SNDL announced on December 30th that it had used its newly raised stock market money to buy the $58 million Zenabis debt from its owner, then announced on December 31st that it was calling in the note over a lousy $7 million payment default. Happy New Year.

Zenabis released a rambling press release January 6th about how it had the money! Or… at least it had a way to get it. There was an understanding with the lender, you see… but then Sundial BOUGHT the lender and… it was a RAID, man! By January 22nd, Zenabis had borrowed another $60 million, and given up 6 million shares for the privilege, to pay off Sundial, who presumably kept the royalty on Zenabis’ cannabis revenue.

As of Wednesday’s close, the SNDL that wrote off more product than it sold in its last reported quarter, by a lot, had a market cap of about US$4.6 billion dollars.

Zenabis, whose dialed-in operations couldn’t earn enough to keep SNDL from scalping it over a measly $7 million was worth $139 million. Canadian dollars.

The Difference?

Part of the reason SNDL has managed to catch the new retail wave while Zenabis has failed to is surely the NASDAQ listing. The appetite for cannabis stocks among the zero-commission app traders in the US is such that the 11.3 billion shares that SNDL has traded in 2021 might as well have traded one share at a time.

Beyond the listing, the material differences creating the disparity in appeal are anyone’s guess, but our guess is that it comes down to marketing. The Dive‘s staff are starting to feel like the last people in the world who read financial statements in a market landscape where the businesses behind the stock don’t seem to matter.

Steve made his SNDL pick betting against himself, and it’s easily the call of the year (so far). Accordingly, the data-rich investor outreach that has been a Zenabis staple ever since unofficial evangelist Kelly Brown was busting in on everyone’s twitter feed to show how much trim ZENA produced per square foot of floor space or whatever is looking pretty stale.

The Zenabis investor deck is a very comprehensive document put together by a talented, diligent IR staff who are still living in the intellectual renaissance of the 2010s, when everyone was an amateur data scientist who liked to make themselves feel smart by asking “why?” In the 2020s, nerds are back to being shoved in lockers, and SNDL has that figured out.

Its deck is all pastel colors and glossy product shots. The numbers are all towards the back of the deck, in formats that make them easy to scan and forget.

The ZENA deck, by contrast, demands attention to be understood, because it caters to information-thirsty, diligence-oriented investors that the companies out-competing them in the capital markets are happy to let them have. Let the numbers fiends look it up. Right now, there are more aggregate dollars available from investors who just want to buy STONKS!

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

This article is one of the best I’ve come across lately. In terms of detail and facts, along with a bit of humour (for y’all Northern, North Americans)

Thanks for the information and insight into SNDL. I can’t get over the people who just wanted to dip their toes in the water first. Lol. $2.87/per? Hell, give me 2. You only live once!

(I’m glad I bought at $1.30. And I dove in head first less than 30 minutes after eating!)

Let’s see if their strategy goes somewhere. Fingers crossed

Thanks for reading!

I’m confused. Are you praising Zenabis or just dissing Sundial? In your last article it seemed you weren’t too fond of Zenabis and in this one you are putting Zenabis on a bit of a pedestal – at least in regards to Sundial.

Thanks for reading Geremia.

This is more an account of what happened, noting that SNDL has been able to use the capital markets to its advantage and put itself in a position to take advantage of ZENA, a better operation that hasn’t been as successful in the markets.

To the extent I’m “praising” or “dissing” anyone, I’ve given Sundial credit for having a simple message, and pointed out that Zennabis’ more information-dense messaging hasn’t helped it.