On March 18th, BMO Capital Markets’ updated its model for SSR Mining’s (TSX: SSRM) based on recently filed technical reports, which were released in late February. Though BMO Capital Markets raised their 12-month price target on SSR Mining to $26 from $24, they lowered their net asset value by 5%. They write, “With an expected stable production outlook in the medium term, and a strong balance sheet, we are increasing our target price to $26 to reflect premium multiples we think SSR is deserving of.”

SSR Mining has seen a steady increase in their average 12-month price target from their 4 analysts, the average has gone up from US$25.19 in late February to $27.58 now, which represents a 28% upside to the current price. All 4 analysts covering the stock have a buy rating on it, while the highest 12-month price target sits t US$29.75 from CIBC and represents a 37% upside to the stock price.

On the technical reports released late February, BMO Capital Markets says that compared to their previous assumptions, which were not given, the overall reserves increased. The main contribution comes from Adrich now being included in the reserve case at Coppler. Though BMO has increased its longer-term cost assumptions, as BMO now assumes that operating costs will grow slightly from $671.5 million in 2021 to $695.9 million in 2023. They now believe the net asset value to be $14.44 per share at a longer-term price of $1,400/$20 per ounce of gold/silver.

Onto updating their models based on the company’s guidance, they say that they have the company spending $218 million of capital at Copler. Most of the spending at this mine will be done in 2024, which will bring on a copper concentrator in 2025. Because of this, BMO lowered its net asset value to $1.28 billion, down 9%. While also the resource updates at Seabee to show lower grades, lowering their net present value to $356 million from $445 million. They also elected to lower their Marigold valuation from $785 million to $696 million.

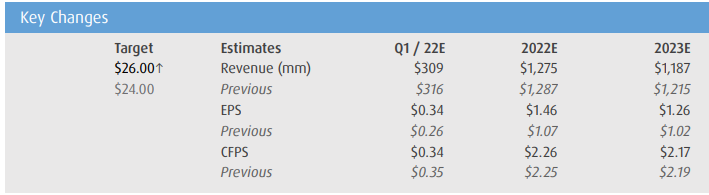

Below you can see the impacted financial results as a result of the changes made to BMO’s model.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.