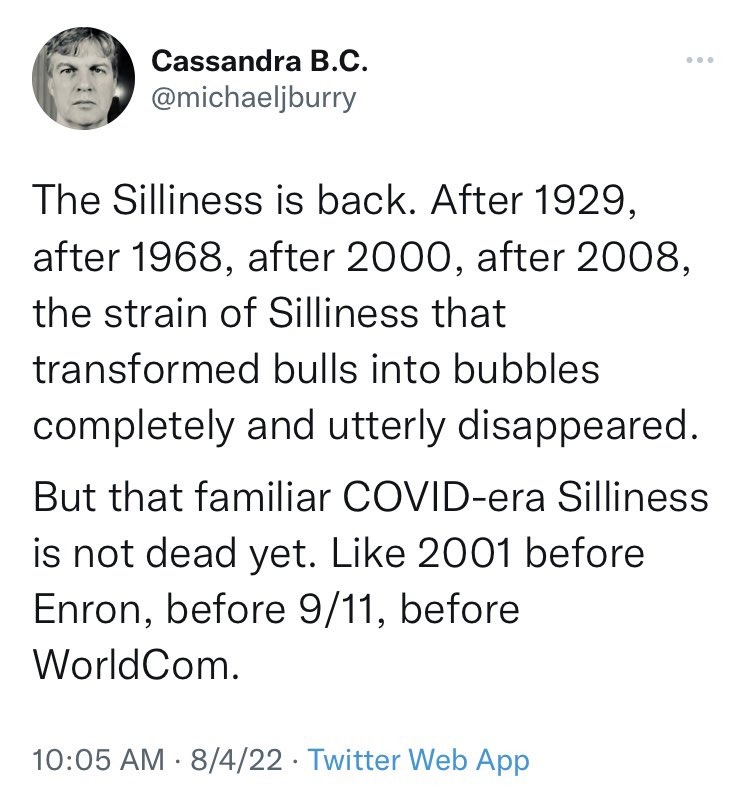

Does Michael Burry know something the rest of us don’t? After successfully waging against subprime mortgages leading up to the 2008 financial crash, the Scion Capital owner warned last week that “the silliness is back,” and that asset prices that became inflated during the Covid-19 area are slated for a hard crash.

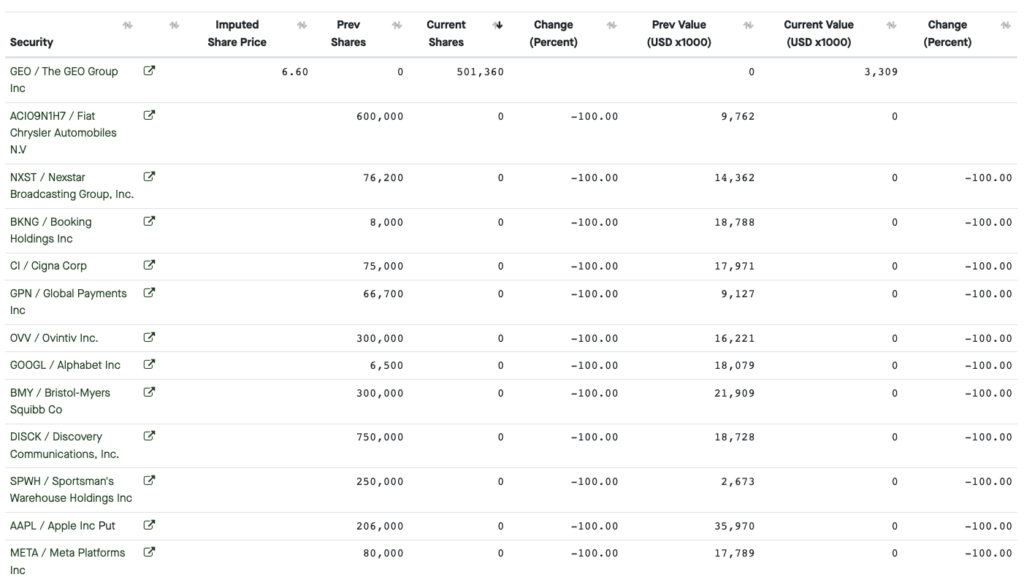

As such, Burry took his warnings about a hard impending economic crash to heart, and did what few in his position would even fathom doing: the asset manager liquidated his entire US stock portfolio, valued at around $200 million as of March 31, keeping only one security: jail operator GEO Group. The freshly disclosed 13F, which is a requirement for anyone who manages funds in excess of $100 million, only shows a snapshot of second quarter holdings and securities trading on US exchanges, failing to reveal details on short positions or non-US traded stocks.

Most notably, his hedge fund sold all positions in Meta platforms, Alphabet, and Bristol-Myers, as well as exited Apple puts totalling around $36 million in notional value. With news circulating that Burry now only holds shares of Geo Group, the company’s stock surged 12% to around $7.68. It remains unknown why ‘The Big Short’ investor liquidated the entirety of his portfolio, but given his dire predictions about a “bullwhip effect” plaguing the US economy and a central bank that may prematurely start cutting rates if inflation slows, he may be onto something.

Information for this briefing was found via the SEC and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.