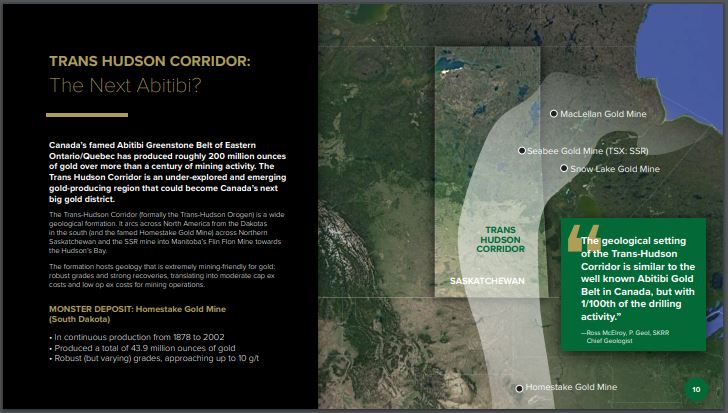

With the recent rise in the price of gold to record levels, gold exploration has seen a strong resurgence in interest from both retail and pro investors. Much of the exploration activity is focussed on the usual areas of interest – i.e. British Columbia’s Golden Triangle region, the Red Lake Mining camp in northwestern Ontario, and the Timmins Gold district in Northern Ontario. The latter, of course, is part of the prolific Abitibi Greenstone Belt, which spans the Quebec-Ontario border – an area with historical production in excess of 200 million ounces of gold.

The focus being centered on the above regions is not surprising. Those regions offer gold explorers and their investors a reasonable risk/reward scenario for their exploration dollars. And several of these regions are close to Toronto, the world capital of mining finance.

Saskatchewan is the world’s leading potash producer and the second biggest uranium producer. The province is also the second largest oil producer in Canada, with estimated reserves of 1.2 billion barrels and a large, well developed pipeline infrastructure.

Shore Gold, in 2004, made a diamond discovery near Fort a La Corne in central Saskatchewan. Plans are in motion to bring the 66 million carat Star-Orion South project into production. This area contains some of the largest kimberlite fields in the world, and has prompted more diamond exploration, particularly in the northeastern part of Saskatchewan.

It is ironic that Saskatcewan was rated the world’s second best mining investment jurisdiction in 2018 – yet total investment in gold exploration that year was only just over $3 million. This situation is now changing.

Geology

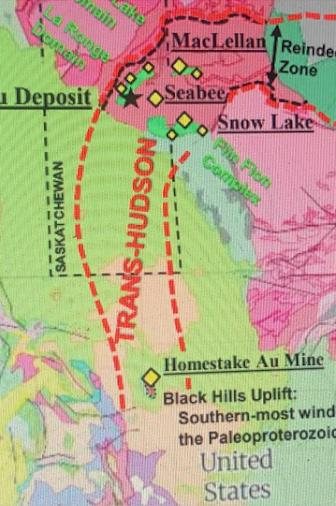

The Trans-Hudsonian Orogeny was a geological event that occurred approximately 1.8 to 2 billion years ago. It came about due to a collision of several ancient continents and Cratons that formed mountains, as well as the Precambrian Canadian Shield and the Great Plains. In the process, it created the Trans-Hudson Orogen Transect, considered to be the world’s largest paleoproterozoic orogenic belt.

The Trans-Hudson Orogen Transect stretches from present-day western Nebraska/eastern Wyoming, northward through western South and North Dakota/eastern Montana, and through to northern Saskatchewan. Here it veers eastward through Manitoba, under Hudson’s Bay, across northern Ontario, Quebec, Labrador and into Greenland. Greenstone belts such as the Abitibi, Flin Flon, and Pine Lake can be found within this massive formation.

Over time, erosion of the earth’s crust flattened the mountainous parts of this formation in the area of central North America, now known as the Great Plains. Subsequent periods of volcanic activity and other repeated geological events formed many of the volcanogenic sulphide (VMS) greenstone belts found within the Trans-Hudson corridor – and these host precious mineral and base metal deposits.

The last remaining vestiges of prehistoric mountains are found in the Black Hills of South Dakota. These rise up 4000 ft above the flat terrain – and this is where North America’s biggest and deepest gold mine, the venerable Homestake Mine, is located. Homestake produced almost 44 million ounces of gold during its mine life from 1878 until its closure in 2002.

Existing Mines

The Seabee Mine and Santoy Mine Complex, currently operated by SSR Mining (TSX: SSRM), is a successful high-grade gold mine in northern Saskatchewan, located 125 km northeast of La Ronge. The mine has produced 1.2 million ounces of gold since opening in 1991.

The Seabee Gold Operation has been in continuous production since November 1991 and has produced 1,200,000 ounces of gold from the Seabee Mine and the Santoy Mine Complex. According to SSR’s report as of December 31, 2019, the mine has proven and probable mineral reserves of 500,000 ounces of gold at an average grade of 10.17 g/t.

HudBay Minerals (TSX: HBM) operates several mines in the Flin Flon and Snow Lake areas of Northwestern Manitoba. The flagship 777 copper-zinc mine in Flin Flon, a town that straddles the Manitoba-Saskatchewan border, has operated since 1930.

Alamos Gold Inc. (TSX: AGI) is in the process of putting its Lynn Lake Gold Project into production. A feasibility study completed in late 2017 determined that the mine could produce 143,000 ounces of gold per year over a 10-year mine life. Currently it’s in the permitting stage, which can take up to take two years.

An Environmental Assessment Plan was filed this past May, and if permits are granted, it will take another two years of construction to complete the mine for production. Situated on the Lynn Lake Greenstone Belt, the Project is the site of two past-producing mines, the MacLellan and the Gordon. This provided the project with existing infrastructure and access to low-cost power. The feasibility study indicated that it would be an open pit operation with an all-in operating cost of $745 per ounce gold. At today’s record gold prices, that makes for a very profitable mine.

Alamos has said that the project has total proven and probable reserves of 26.8 million tonnes at 1.89 g/t gold and 2.99 g/t silver. Estimated contained gold is over 1.6 million ounces. 4.8 million is the measured and indicated tonnes at 1.58 g/t gold and 1.4 million inferred tonnes at 1.48 g/t gold.

Exploration Activity

Currently there are two junior exploration companies actively working in the area. Taiga Gold Corp (CSE: TGC) has five projects in the vicinity of the Seabee and Santoy mine complex. Their flagship Fisher project is strategically located on the north and south sides of the Seabee Complex. Fisher was optioned to SSR Mining, who have been drilling since early 2018 in an effort to expand the mineral reserves around the mine.

Taiga has four other early stage projects;

- The Orchid property, located 70km south of the Seabee Mine, is considered to be on trend with Seabee and sits within the gold bearing Pine Lake greenstone belt formation. Previous work results have been encouraging, with many high-grade showings within the structure. On June 22, 2020, the Company announced that it had completed staking activity at Orchid property.

- The Leland property is located 23 km southwest of the Seabee Mine. Previous work on the property has shown a number of high-grade gold occurrences that warrant additional exploration. Interestingly enough, on May 21, 2020, Taiga entered into an option agreement with the other company working in the region, SKRR Exploration (CSE: SKRR). The deal enables SKRR to earn up to 75% of the Leland property.

- The Chico project is a 4,657 hectare property located 45 km southeast of the Seabee Mine. In 2018, Taiga optioned 80% of the Chico property to Aben Resources (TSXV: ABN). A planned 2018 drill program was suspended at the request of two local First Nation groups.

- The SAM property is the only Taiga project not in the proximity of the Seabee Mine. It is located 15 km east of Flin Flon, Manitoba and is situated within the Amisk Group volcanic belt. This belt hosts the Flin Flon and Snow Lake base metal and gold deposits, near the Birch Lake and Flexar past-producing mines. Although searching primarily for gold, previous work on the property has revealed the presence of copper and zinc. On June 29, 2020, Taiga initiated a fieldwork program intended to build upon the results from their 2018 fieldwork program.

SKRR Exploration Inc. (TSXV: SKRR) has four exploration projects within the Trans Hudson Corridor. Principals Ross McElroy and Ron Netolitsky, are very familiar with the area from their previous professional experience. Mr McElroy and his team are credited with the discovery of the Cameco Corp (TSX: CCO) potash mine in central Saskatchewan.

Mr Netolitsky, for his part, was one of the geologists involved in the discovery of the legendary Eskay Creek Mine in the Golden Triangle region of British Columbia. He was also involved heavily in the Athabasca Basin uranium rush in northwest Saskatchewan and gold exploration in the La Ronge gold belt, now being revisited by SKRR.

It is rare for a junior exploration company like SKRR to have management with such a depth of experience and breadth of success. This credibility will enhance their ability to readily access capital markets for SKRR when funding is required.

On July 27, 2020, SKRR announced that the initial fieldwork portion of their 2020 exploration program at their flagship Olson property was completed. The fieldwork data will be used to determine the likely targets for their upcoming 2020 fall drill program.

As mentioned above, SKRR obtained an option for 75% of the Leland Project from Taiga. This, combined with SKRR’s Irving Project, results in a 23,500 hectare land package. Both have shown gold mineralization from previous work done on the properties.

The Ithingo Project comprises 2849 hectares spread over 12 contiguous mineral claims located 235 km northwest of La Ronge. SKRR’s interest in this project stems from historical drill data from 57 drill holes done by previous exploration companies. There are strong gold showings and the potential for a high-grade deposit.

The Trans-Hudson Corridor has not been heavily explored in the past and it does not carry the cachet of Red Lake, the Abitibi Greenstone Belt, or the Golden Triangle. It has had, though, a number of successful high-grade gold mines in a proven mineral rich region.

Companies currently operating there know the region intimately and their management teams have the experience and expertise to identify and develop promising exploration properties into economically viable operations.

As with investing in any exploration ventures, there is a high-risk/high-reward element to any of these situations. These companies mentioned could enjoy first-mover advantage by being early entrants and becoming big fish in a small pond. And unlike some of the more popular exploration regions, it’s easy to track developments. Who knows – a significant discovery could potentially bring a gold rush to Saskatchewan. Stay tuned as exploration happens and the drills turn!

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: SKRR Exploration is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover SKRR Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.