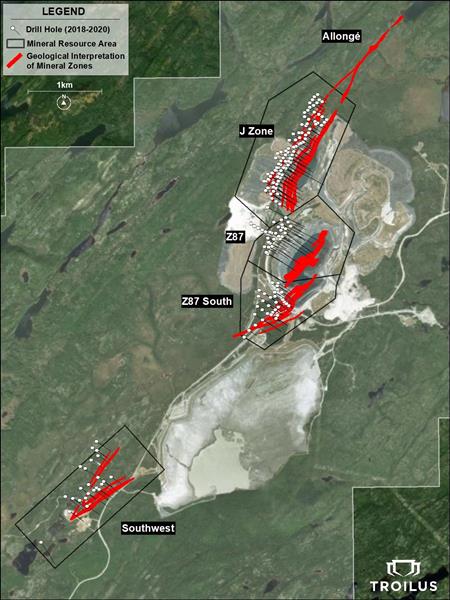

Troilus Gold Corp (TSX: TLG) announced a new 20,000 metre drill campaign this morning for its flagship Troilus property near Chibougamau, Quebec. The newly announced drill program is expected to be completed yet in 2020, with the company focused on expanding the current mineral resource estimate that the property has.

Drilling during the fall campaign will be focused on the exploration of further mineralization across the property, following the discovery of a new zone earlier this year. Drilling will also be conducted in the Z87, Z87 South, and J zones on the property, where the company will be focused on upgrading current inferred resources within the open pit mineralization estimate. Drilling here will support the planned prefeasibility study.

The Troilus project currently has a mineral resource estimate of 4.96 million ounces of gold equivalent at an average grade of 0.87 g/t gold equivalent, along with an inferred mineral resource of 3.15 million ounces of gold equivalent at an average grade of 0.84 g/t gold equivalent. The drill program as a result will look to expand and extend mineralization near surface to support the development of an open pit mine.

Three drills are said to be already turning on the property, with the program currently targeted for a 2020 completion. However, the company has indicated that it also aims to continue drilling aggressively in the new year.

The Troilus property currently had a preliminary economic assessment conducted, revealing an after tax internal rate of return of 22.9%, along with a net present value of $576 million based on gold being priced at $1,475 per ounce. That rises to an internal rate of return of 38.3% and a net present value of $1.15 billion at an average gold price of $1,950 per ounce.

Troilus Gold last traded at $1.30 on the TSX.

Information for this briefing was found via Sedar and Troilus Gold Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.