On June 8th, Uranium Energy Corp (NYSE: UEC) announced that it had closed a number of transactions. Firstly the company announced that Anfield Energy (TSXV: AEC) settled debt that UEC became the beneficiary of as a result of the acquisition of Uranium One Americas for $18.34 million. The company notes that it will have over $182 million of cash and liquid assets pending the closing of the indebtedness and “pending return of certain surety amounts.”

The settlement consists of $9.17 million in cash and 96,272,918 units of Anfield which consist of one common share and one purchase warrant exercisable at a share price of C$0.18.

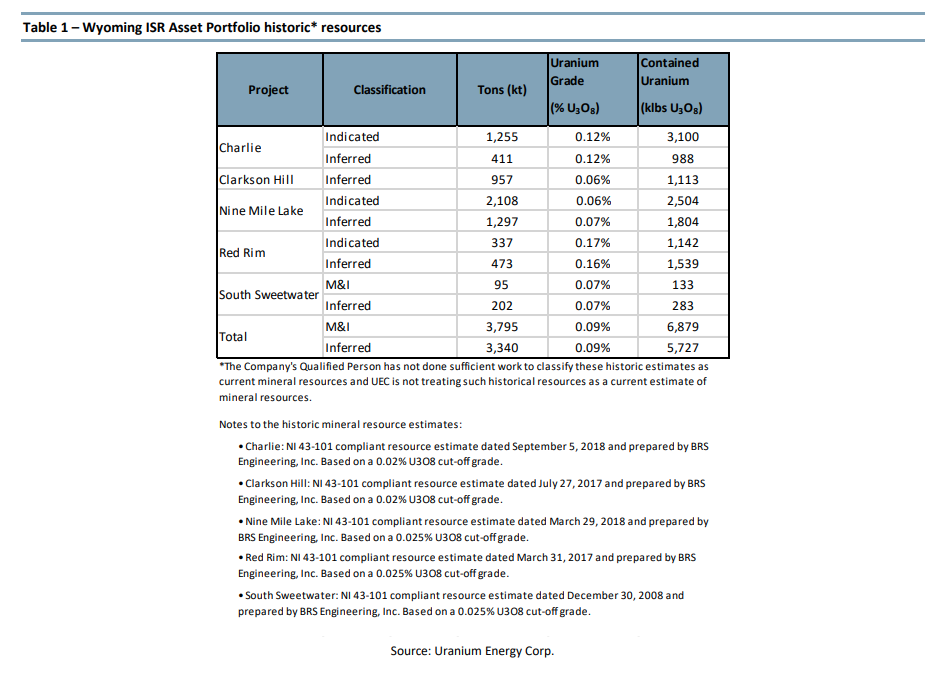

Additionally, the company completed a proxy swap agreement with Anfield, in which Uranium Energy Corp will receive Anfield’s portfolio of 25 in-situ uranium projects in Wyoming in exchange for Uranium Energy’s Slick Rock and Long Park projects. The company says that this swap will increase its Wyoming land holdings by 50%, adding 55,119 acres of mining claims.

Uranium Energy Corp currently has 5 analysts covering the stock with an average 12-month price target of US$6.30, or an upside of 57%. Out of the 5 analysts, 1 has a strong buy rating, 3 analysts have buy ratings and a single analyst has a hold rating on the stock. The street high price target sits at U$7.20 and represents an 80% upside.

In Haywood Capital Markets’ note on the news, they reiterate their buy rating and US$6.60 12-month price target on the stock, saying that Uranium Energy Corp now has the largest ISR project portfolio in the U.S while reiterating their top pick in the uranium sector.

Haywood notes that Uranium Energy has US$40.2 million in physical uranium on hand and that that before the asset swap, their Wyoming hub-and-spoke system included over 69 Mlb of U3O8, and that the swap will increase the resources by 12.6 Mlb of U3O8.

Lastly, Haywood says that Uranium Energy Corp is an excellent way to gain leverage to uranium spot prices and notes that the market demand for uranium equities has been “voracious,” and the best they’ve seen since pre-Fukushima. They also say that Uranium Corp sits “atop of a small group of US-based neo-producers,” which has the ability to quickly move to production if/when the spot prices move. They believe that Uranium Energy is in the position to control “multiple permitted, near production-ready uranium ISR assets in the U.S.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.