Vizsla Silver (TSXV: VZLA) got its second analyst coverage by an investment bank last week, with Canaccord Genuity issuing a C$4.00 price target, which is an 85% upside to the current pric,e and a speculative buy rating. Earlier last week, PI Financial initiated coverage, being a little less bullish, giving Vizsla Silver a C$3.25 price target and buy rating.

Vizsla Silver is an early-stage mining company that has started to make progress in developing its Panuco silver-gold project. The project was acquired back in 2019 and since then the company has announced many new discoveries by drilling over 70,000 meters in 305 holes.

Canaccord’s analyst, Michael Pettingell, starts the note off by asking “Is Panuco the next Las Chispas?” He asks this because, all though it’s in earlier stages than the Las Chispas project, “both projects represent past-producing Mexican silver districts, that until recently, had never been systematically explored due to fragmented land ownership.” Another similarity is the grade distribution for silver which you can find in the chart breakdowns below.

The last similarity is what Pettingell calls “developing critical mass,” which basically means that any sort of additional money put into this project to fund exploration will be a value add. He writes, “in our view, Vizsla now has a clear path to outline a maiden resource base at Panuco of >50Moz AgEq.” He adds that Vizsla has the option to purchase the 500 tpd El coco mill which should allow the company to fund future exploration as the project has positive free cash flow.

Pettingell says that the company is well-positioned to execute as they have roughly $93 million in cash plus a potential additional $11 million due to in-the-money options. “The company remains well funded to deliver a near-term maiden resource and complete its ongoing exploration program at Panuco,” he writes.

Pettingell points to a few key potential catalysts that could arise as the Panuco project continues on its way to being built out. Here are the four catalysts below:

- Ongoing results from 2021 resource/discovery-based drilling (+40,000m with eight rigs planned for H1/21)

- Exercise earn-in option(s) to acquire 100% ownership of the district

- Property wide airborne EM survey results H2/21

- Maiden project resource in Q1/22

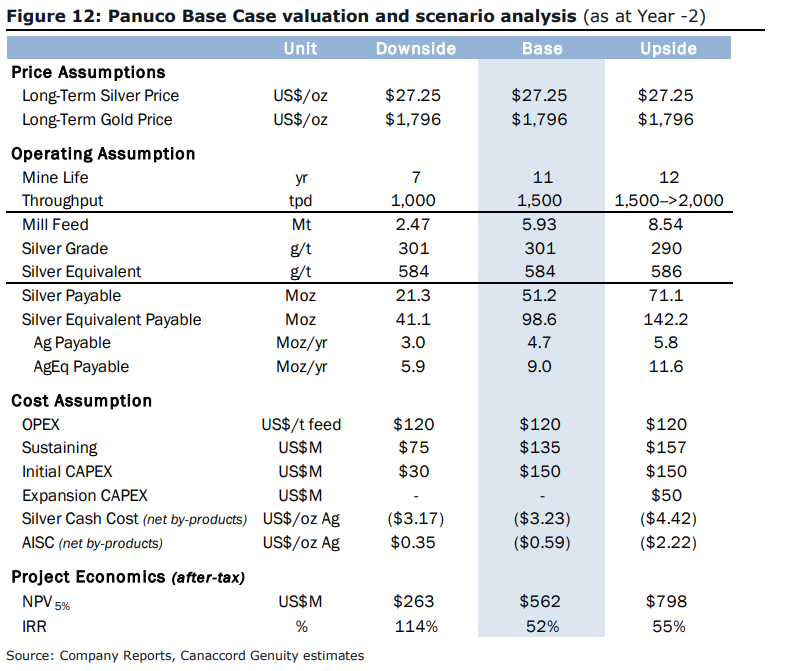

Below you can see Canaccord’s projections for Panuco based on three scenarios.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.