Shares of AMC Entertainment Holdings, Inc. (NYSE: AMC) have soared over the past two weeks as retail investors’ interest in meme stocks, particularly the core meme stocks AMC and GameStop Corp. (NYSE: GME), has exploded. While not the only reason for the meme stock renaissance, the market’s decision to embrace AMC’s unusual investment in a struggling gold miner, Hycroft Mining Holding Corporation (NASDAQ: HYMC), has been a factor in the revaluation of the sector.

It is instructive to consider the amount of value added to AMC’s stock market capitalization since the March 15 investment in Hycroft versus AMC’s tangible gain on the Hycroft investment.

Specifically, AMC and Eric Sprott, a well-known precious metals investor, each purchased 23.4 million common Hycroft shares and 23.4 million Hycroft warrants (that can be exercised through March 15, 2027 at a US$1.068 exercise price) for a total cash outlay of US$55.8 million (US$27.9 million for each party). At Hycroft’s US$2.32 share price, the securities acquired by AMC are worth US$83.5 million (US$2.32 stock price times 23.4 million shares plus US$1.25 per warrant value times 23.4 million warrants). So, AMC has an approximate US$55.6 million mark-to-market gain on its investment in Hycroft.

At the same time, AMC shares, now priced at US$29.33, have appreciated US$15.77 since its March 14 close of US$13.56. This gain, when multiplied by AMC’s shares outstanding of 516.8 million, implies that the company’s stock market valuation has increased by US$8.15 billion since the announcement of the company’s investment in the gold miner. AMC has reported no other tangible news since March 15.

Clearly, investors could be making a judgment that since AMC management made a profitable investment in this case, the company could potentially make further constructive capital deployment decisions down the road and the stock’s valuation deserves some “extra credit” beyond the one-off gain. Indeed, on March 27, AMC CEO Adam Aron said the company hopes to make additional “third-party external M&A” announcements. (This statement seemed to trigger 45% and 81% rallies in AMC and Hycroft stocks, respectively, during trading on March 28.)

However, the stock market’s conferring a valuation gain on AMC stock equivalent to 147 times its mark-to-market gain on the Hycroft investment seems extraordinarily overdone. Indeed, it is no exaggeration to say that no investment or hedge fund manager, regardless of his/her track record, would ever receive this much credit from investors based on a single investment.

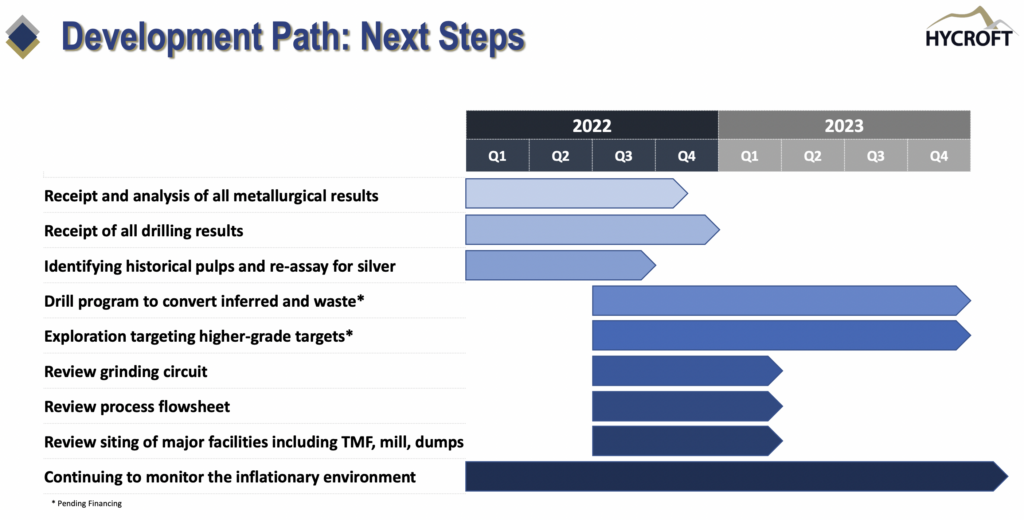

As an aside, Hycroft’s flagship Hycroft Mine, while containing substantial gold and silver resources (15.3 million equivalent gold ounces on a Measured & Indicated basis) is not expected to begin to produce gold — or generate cash flow — for at least a number of years. The table below was in an investor presentation the company made in late February/early March 2022; no mention of gold production is made on a timeline which runs through year-end 2023.

AMC stock seem to have vastly outrun its notable unrealized gains in Hycroft shares and warrants. It seems reasonable to expect that much of these gains will be reversed in the short to medium term.

AMC Entertainment Holdings, Inc. last traded at US$29.33 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.