As a follow up to our quick take this morning on Cronos Group (TSX: CRON, NASDAQ: CRON), we thought it would be helpful to share an illustrated look at Cronos Q3 earnings.

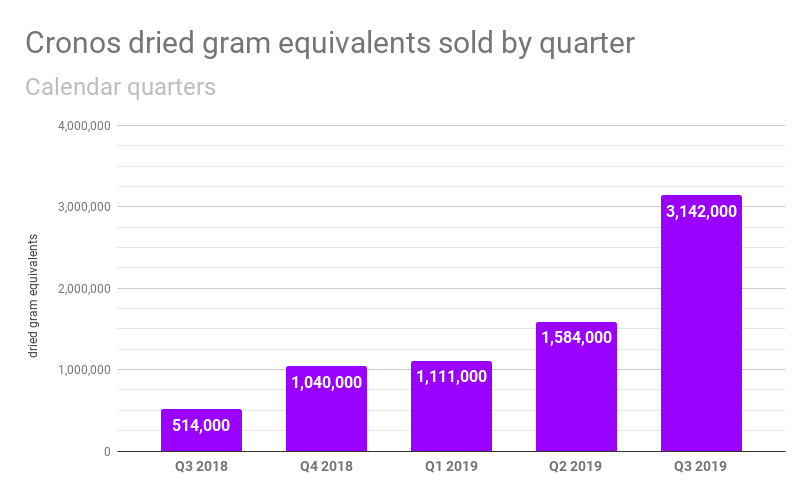

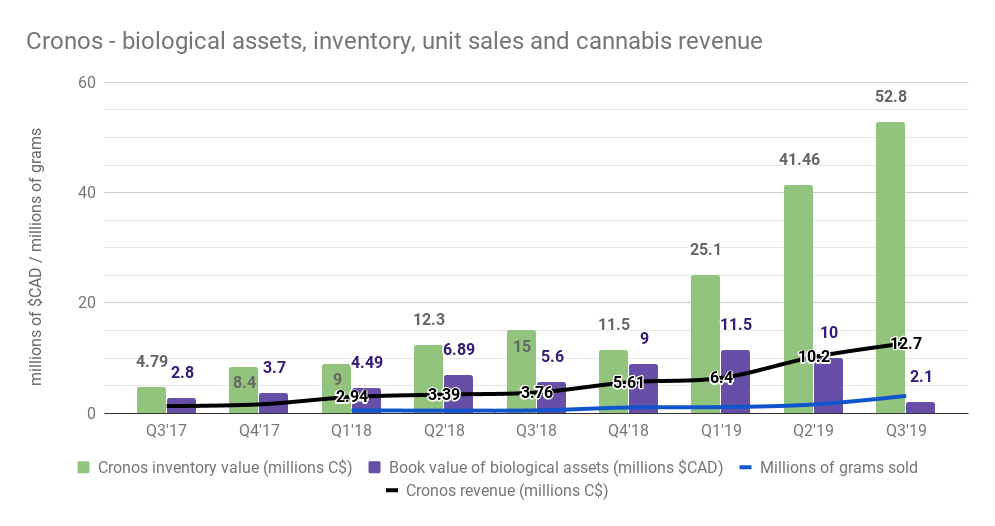

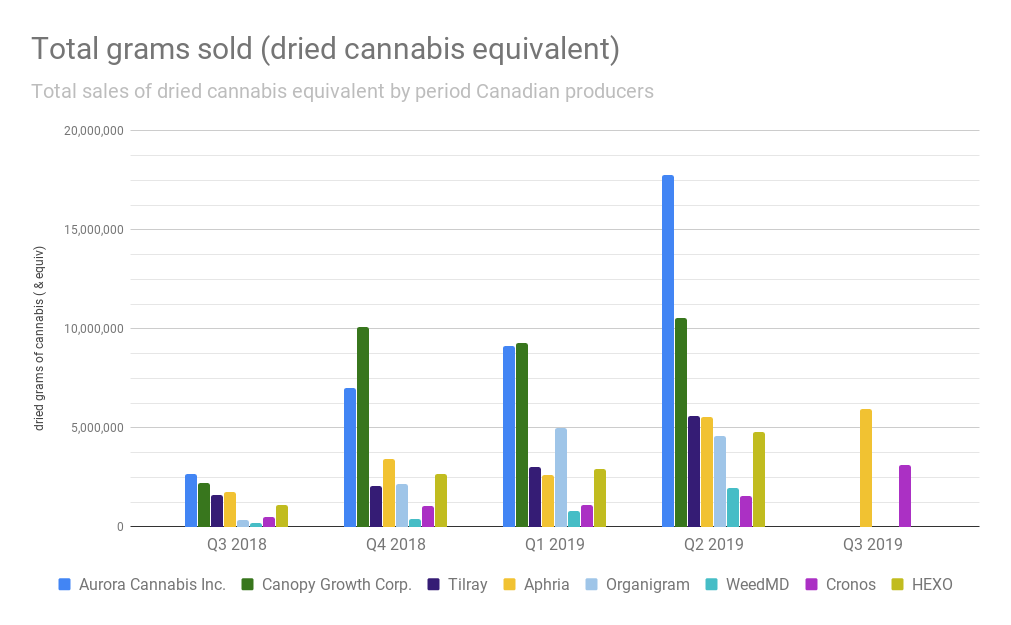

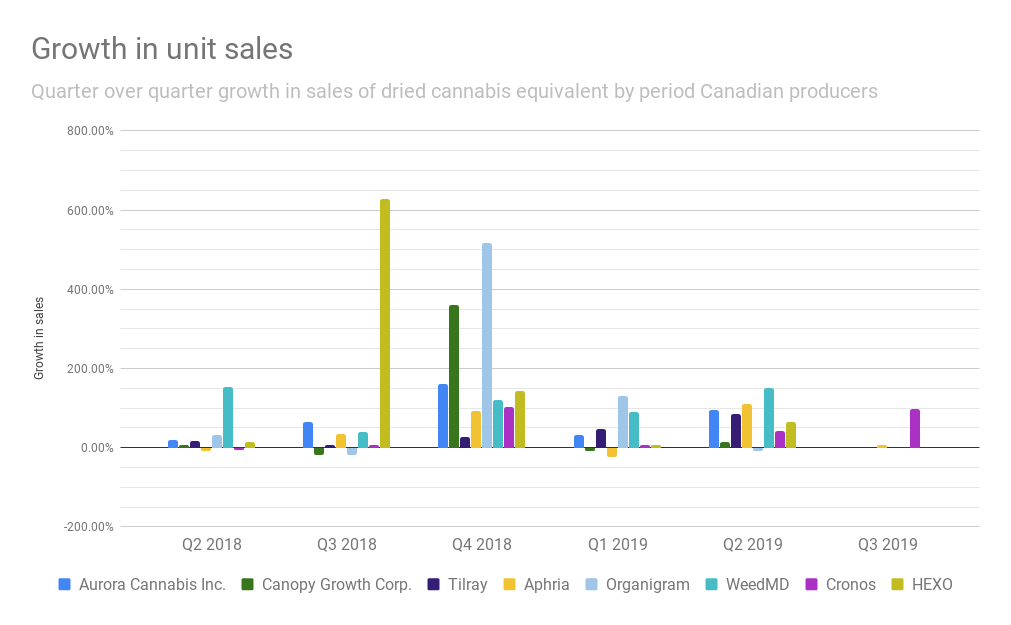

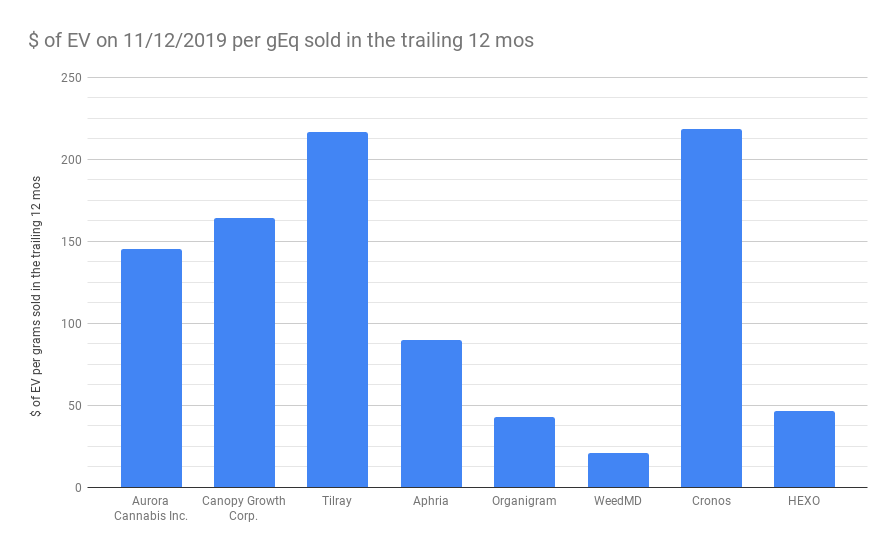

Cronos effectively doubled their cannabis output since Q2, selling 3,100 kg of dried gram cannabis equivalents. That’s about half of Aphria’s most recent quarterly unit sales and a sixth of Aurora’s.

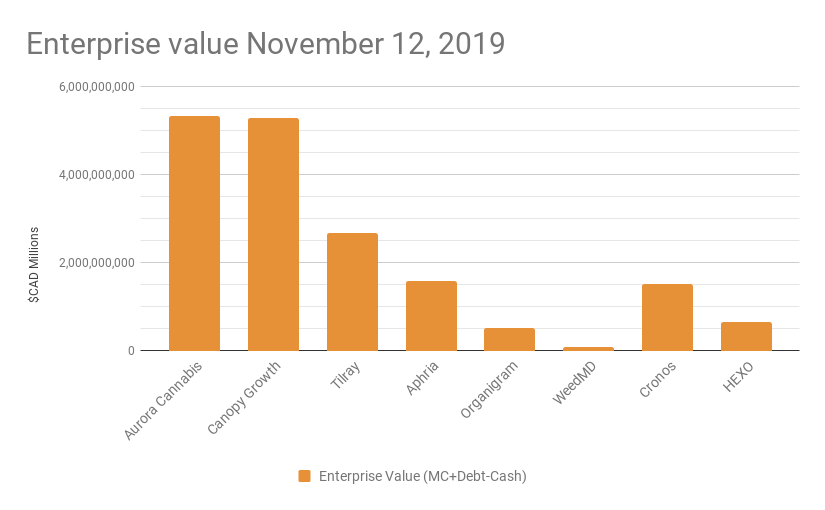

Yet, Cronos’ enterprise value is nearly identical to Aphria’s, and less than a third of Aurora’s. Whether this apparent value gap is tradeable is a matter of opinion, but few would argue with the notion that its roots are in Cronos’ financial position, relative to its peers, and in its backers.

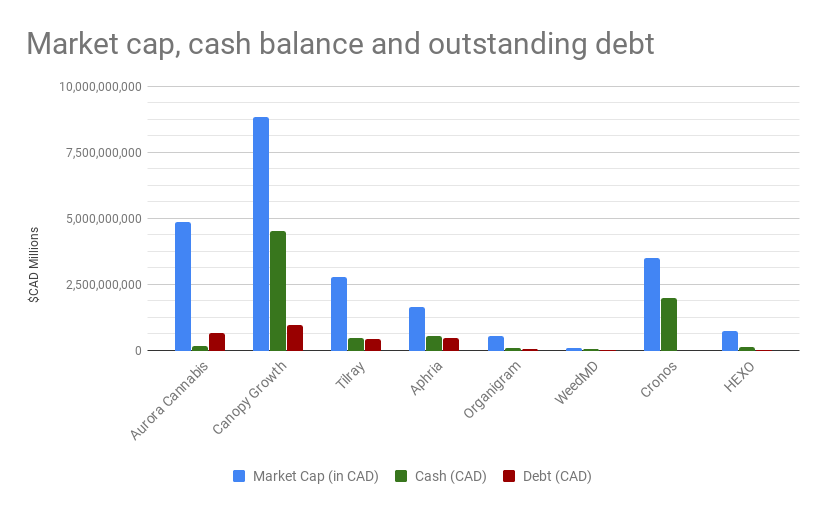

Cronos has $1.92 billion in cash. That’s more than half of its market cap. The company carries no debt. The cash originated in the $2.4 billion equity investment made by US tobacco giant Altria this past December. Altria plans to use Cronos as its cannabis platform globally.

The tobacco business isn’t going anywhere and, more to the point, they have the background and understanding to make this particular type of consumer goods business work.

Cronos does not appear to be bothered by the fact that, among the unicorn-class Canadian cultivators, they have the smallest unit sales. Part of that is the strong growth, but it’s entirely possible that their US backers don’t expect this business to succeed as a Canadian cultivator. Altria may be content to use Canada as a sort of R&D lab. The retail footprint from their tobacco division can be considered a far better head start in the US market than all of the MSO front runners put together. From Altria’s perspective, the key to success in a US cannabis landscape that allows them to participate may well be the consumer product knowledge that they gain from their Cronos experiment.

Information for this analysis was found via Sedar and Cronos Group. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.