The founders of the now-bankrupt crypto hedge fund Three Arrows Capital (3AC) Su Zhu and Kyle Davies seem to don’t know when to quit. The duo, along with their team, is aiming to raise $25 million to start a new crypto exchange.

The announcement of the fundraising comes just two months after the collapse of exchange FTX, which the new crypto exchange seems to be taking advantage. For one, they named the company GTX, with the pitch deck starting with the line: “because G comes after F”.

— Molly (@bigmagicdao) January 16, 2023

One of their offerings also include the ability to transfer their FTX claims to GTX and receive immediate credit in a token called USDG.

In fact, the idea for GTX banks on the huge amount of locked claims, estimated to be $20 billion, following the collapse of a number of crypto firms in the past year.

Zhu and Davies: the ghosting duo

The GTX team touts that they have 60+ developers and 10 years of experience operating a crypto exchange. It is led by Zhu and Davies, who both went silent for a while following the collapse of 3AC in June 2022, but have recently emerged on social media.

After news about 3AC heading towards insolvency circulated in June, it took a while before Davies admitted that the Terra-Luna collapse affected the hedge fund with their $200-million investment in LUNA earlier in the month obliterated.

READ: Three Arrows Capital Explores Asset Sales, Possible Bailout Amid Potential Insolvency

Around the same time, investment documents showed TPS Capital, also operated by the 3AC founders, “was pitching investors on an arbitrage opportunity that involves Grayscale’s bitcoin-linked fund GBTC.”

Following the fallout, crypto trading firm 8 Blocks Capital accused 3AC of using about $1 million of their funds “to answer [3AC’s] margin calls.” The firm had an agreement with the hedge fund for the latter to use their trading accounts for a fee. Under this agreement, 8 Blocks could withdraw at any time, and 3AC would not have any authority to move their funds without their permission.

Still in June, 8 Blocks’ fund monitoring script picked up that about $1 million was missing from their accounts. They then reached out to Davies, as well as the fund’s operations team on Telegram, but received no response.

“They were online and they didn’t pick up,” 8 Blocks CEO Danny Yuan said.

They later learned that 3AC was “leveraged long everywhere and were getting margin-called.” But unfortunately, the fund ignored the margin calls and “ghosted everyone,” resulting in the platforms having “no choice but to liquidate their positions.”

READ: 8 Blocks Capital CEO Says 3AC Ghosted Them After US$1 Million Went Missing From Their Accounts

Voyager Digital also said it has $655 million locked in 3AC after revealing that the latter defaulted on its loan payments. This also contributed to the crypto firm’s eventual bankruptcy filing.

READ: Voyager Digital: 3AC Defaults On Loans, Tens Of Millions Leave Company Coffers Via Withdrawals

Genesis Asia Pacific has also been revealed to have lent the crypto firm around $2.36 billion, making it one of the claimants of the firm’s $2.8 billion outstanding obligations on the bankruptcy process that followed. The funds locked caused a major concern for Genesis who then stated that when collateral was liquidated, it was left with a loss of at least $1.2 billion. This led to also to a domino effect that embroils Genesis’ parent firm Digital Currency Group and Gemini in an ongoing feud.

READ: In A Nutshell: The Digital Currency Group-Gemini Battle

At one point during the 3AC bankruptcy process, Zhu and Davies’ physical locations were said to be “unknown” as court documents state, with the duo only being represented by a lawyer in Singapore.

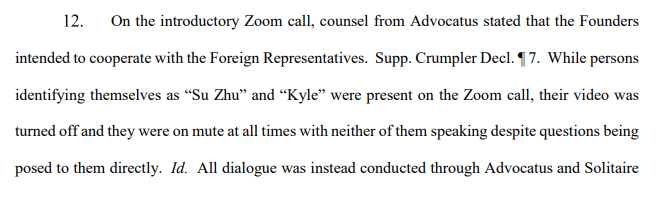

Further, in an introductory Zoom call, while there are users named “Su Zhu” and “Kyle”, both accounts were turned off and muted the whole time.

This was a complete turnaround from Zhu’s promise in his tweet that they are “fully committed” to sorting the insolvency issues.

We are in the process of communicating with relevant parties and fully committed to working this out

— Zhu Su 🔺 (@zhusu) June 15, 2022

READ: 3AC Founders’ Whereabouts “Currently Unknown”, Ghosted Zoom Calls

Around the same time, Zhu and Davies bought a $50 million superyacht named Much Wow, but never got to sail nor even fully paid for it since the duo’s disappearance.

The 3AC founders are collaborating in this new crypto exchange with Mark Lamb and Sudhu Arumugam, the founders of CoinFlex, a cryptocurrency exchange that is also in the process of restructuring. According to one of the decks, the exchange’s leadership team includes numerous CoinFlex executives, including the firm’s general attorney and chief technology officer.

So, if it’s about crypto claims, it seems the GTX team knows a thing or two.

Among the crypto firms GTX plans to unlock the claims of are FTX, Celsius, and BlockFi.

Will 3AC claims be tradeable on GTX? pic.twitter.com/4MvCfe9Pj3

— db (@tier10k) January 16, 2023

Information for this briefing was found via The Block and sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.