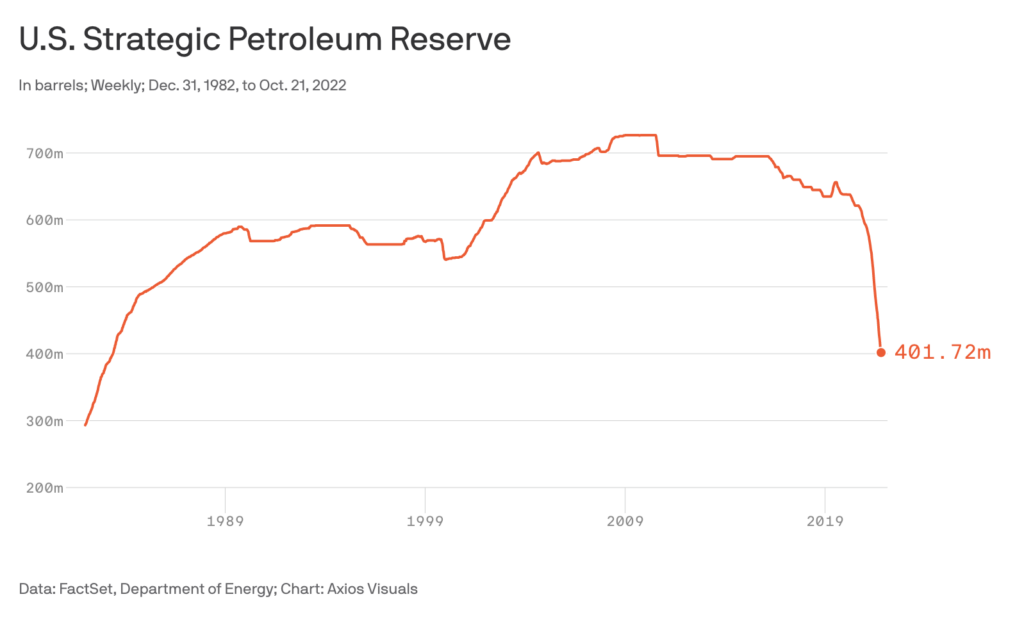

The United States Department of Energy has sold the last batch of crude oil from the historic Strategic Petroleum Reserve (SPR) release. The SPR level is now down to 401.72 million barrels, the lowest since 1984.

The SPR is a federally-owned stock of emergency crude oil that was established to ease the impact of supply disruptions and to fulfill US obligations under the international energy program. It is the largest supply of emergency crude oil in the world.

Earlier in 2022, the Biden administration authorized the release of 180 million barrels — the most ever in the reserve’s history — as a way to bring down skyrocketing gas prices amid Russia’s invasion of Ukraine, a surge in demand as consumers emerged from the pandemic, and US producers initially struggling to raise output.

This week the last of this release made, a total of 15 million barrels, were sold to six companies — Phillips 66, Marathon Petroleum Supply and Trading LLC, Shell Trading (US), Valero Marketing and Supply, Macquarie Commodities Trading US, and Equinor Marketing and Trading.

According to estimates from the US Treasury, the record release slashed gasoline prices by as much as 40 cents per gallon. But the sale also contributed to the unraveling of the US’ relations with Saudi Arabia. The middle eastern country sided with Russia at OPEC in October and announced an oil production cut of 2 million barrels per day.

In response, President Joe Biden said that it would authorize the release of more oil from the emergency reserve in early 2023 to cut gas prices.

Information for this briefing was found via Reuters, Axios, the US Department of Energy, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.