November has been a busy month for Cronos Group (TSX: CRON) (NASDAQ: CRON) in terms of insider transactions. The company this month has seen multiple insiders sell portions of their current holdings of the company, ending the long stretch since December 2019 wherein no insiders disposed of any holdings.

As per Sedi filings, the insider selling began the day following Cronos’ third quarter financial results being reported. The quarter was notable in that it marked the fourth straight quarter of gross losses for the company, with the firm reporting net revenues of just $11.4 million. With operating expenses of $39.6 million, the firm is a long way from any semblance of profitability.

It seems that director Jason Adler of Gotham Green Partners fame is less bullish on the outlook of the company following the financial results, given that he has conducted five separate sales transactions this month. The first, which saw a total of 100,000 disposed of at $7.60 on November 6, generated him $760,180 in gross proceeds. Here’s a better breakdown of his overall transactions this month.

- Nov 6 – 100,000 shares sold at $7.60 for proceeds of $760,180

- Nov 9 – 769,339 shares sold at $7.73 for proceeds of $5,946,298

- Nov 10 – 21,361 shares sold at $7.30 for proceeds of $155,915

- Nov 11 – 9,300 shares sold at $7.30 for proceeds of $67,890

- Nov 17 – 100,000 shares sold at $7.33 for proceeds of $733,400

All told, Adler pocketed just shy of $7.7 million through the sale of 1,000,000 common shares over the last several weeks. He still maintains ownership over 4,512,396 common shares directly, as well as he is believed to continue to hold common shares of the equity in multiple Gotham Green Funds.

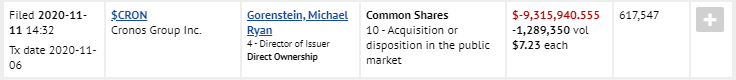

Next on the list of those of whom filed sales this month is Michael Gorenstein, former CEO and now executive chairman of the company. Gorenstein sold even more than Adler, registering a total of 1,289,350 common shares being sold – a majority of his ownership stake – for proceeds of $9,315,940 on November 6, 2020. Gorenstein then had just 617,547 remaining in direct ownership.

However, a week later he then exercised 4.0 million warrants in the company ay $0.245 per share at a cost of $980,000. Following the “exercise for cash” of 105,151 shares, his resulting ownership stands at 4,512,396 common shares.

It should be noted however that the sales recorded by both Adler and Gorenstein are believed to be in US dollars, given that the price of the equity in Canadian dollars was between $8.67 and $11.40 within the time frame listed, and never entered into $7 territory.

The final share sale filed this month comes from Chief Commercial Officer William Hilson. However, the transaction actually occurred nearly a year ago on December 9, 2019, when Hilson sold 7,500 common shares at a price of $9.33 each for proceeds of $69,975, leaving him with 892,500 common shares.

Cronos Group last traded at $7.22 on the Nasdaq.

Information for this briefing was found via Sedar, Sedi and Cronos Group. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.