On August 9, Curaleaf Holdings (CSE: CURA) reported record second quarter financial results. The company reported total revenue of $312.2 million, up 20% sequentially and 166% year over year. Gross profit came in at $115.23 million, up 21% sequentially and 156% year over year and a profit margin of 49.6%. Adjusted EBITDA came in at 84.37 million up 35% sequentially and 201% year over year.

No analysts changed their 12-month price target on Curaleaf with the consensus average staying flat at $28.28. Curaleaf has 15 analysts covering the name with 5 having strong buy ratings and the other 10 have buy ratings. The street high sits at $34 from BTIG while the lowest comes in at $24.

Canaccord Genuity reiterated their $24 price target and buy rating on Curaleaf, saying that the company reported strong revenue growth with margin expansion.

Curaleaf basically reported in-line results with Canaccord’s estimates but Canaccord says that shouldn’t be what is being talked about, rather the 20% quarter-over-quarter increase should be the big takeaway.

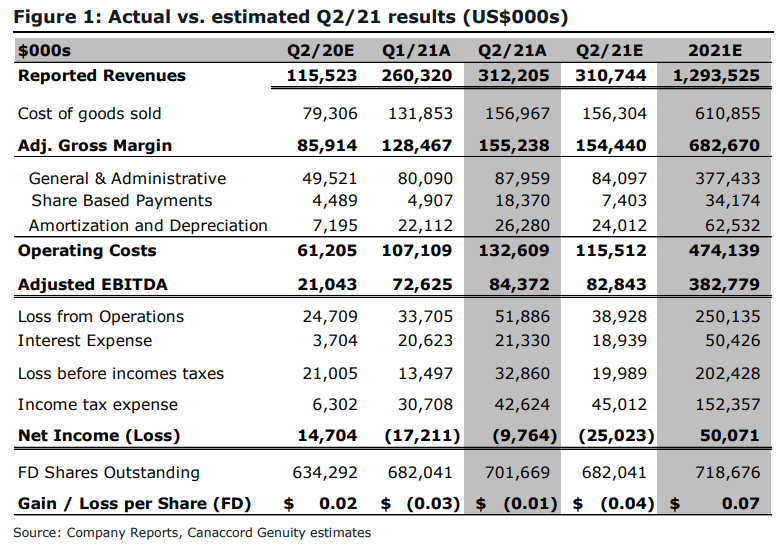

Below you can see Canaccord’s second-quarter estimates. They say that Illinois, Pennsylvania, Florida, and Arizona attributed the most to the quarter alongside opening 5 new dispensaries. EMMAC, now called Curaleaf International, meanwhile contributed roughly $5 million to the quarter.

Canaccord makes note of the Los Suenos Farms acquisition, which owns 3 indoor cultivation sites and a 1,800 plant indoor facility which is located on 66 acres of property. Canaccord adds, “We note that the company has already started to carve out a meaningful presence in Colorado’s ~US$2.2B markets via its Select branded products. The addition of LSF allows CURA to become 100% vertically integrated in the state while adding an asset that is anticipated to aid in its overall low-cost cultivation profile.”

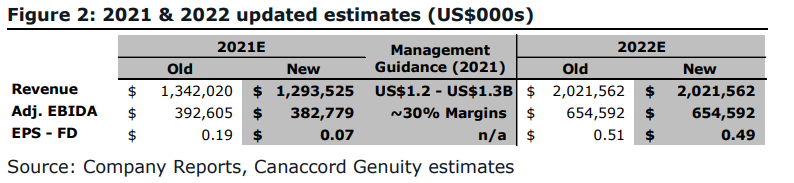

Below you can see Canaccord’s updated full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.