Two weeks ago, Stifel-GMP hosted an investor meeting for Eguana Technologies (TSXV: EGT) which was primarily focused on the recent news that it will start to white label manufacture with Omega EMS and PowerCenter+. Stifel’s key takeaways are that the revenue opportunity could be a lot higher than previously expected, as the proportion of 10 kW Max Full Home Backups sold will be higher than the traditional 5 kW option.

Stifel elected to reiterate their buy rating and C$0.85 12-month price target, which implies a 84% upside to the current stock price.

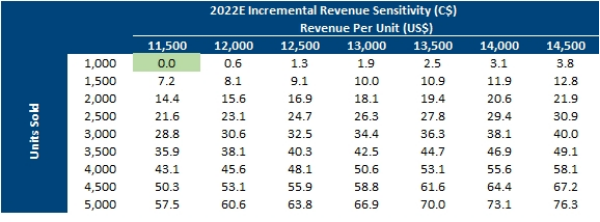

During the investor meeting, Eguana said that their sales mix could be made up of 70% of the 10 kW Max Full Homes Backups and 30% of the 5 kW versions. There is roughly a $5,000 price difference between the two models. This could lead to $185 million in revenue over the next three years versus Stifel’s $144 million estimate currently. Stifel says that this implies a value of $0.82 per share using a blended price of US$14,667 per unit at 6,000 units per year.

Stifel says that this change in sales mix came from Eguana getting customer feedback and believes that the residential customers want more security over the supply to their homes. And although Stifel elects to keep their model at its current $144 million over 3 years as the company ramps up its production, their assumption is that the partnership sells 1,000 units over the first 12-months, then triples to 3,000 in the second year, then doubles to 6,000 units in year three.

Lastly, Stifel says that the company has stated during the investor meeting that it could potentially secure additional partnerships of similar size to PowerCenter+. Stifel writes, “This would be an obvious positive catalyst for the stock if announced.” They believe these partnerships would come in a variety of different verticals.

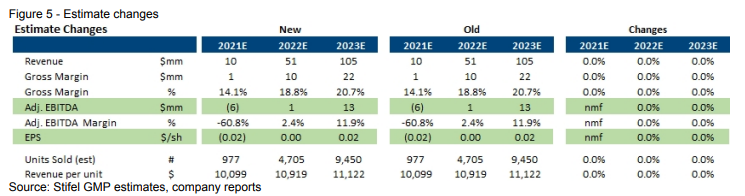

Below you can see Stifel-GMP’s very slightly updated estimates.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.