Feature image adapted from photograph by Flickr user abdulla.saheem

Generated electricity isn’t exactly a perishable product, it’s more of a hyper-perishable product. Whether it’s being generated by a massive industrial power plant or by a home solar array, the watts being generated have to be used as they are made. That’s why industrial producers sell them to consumers in megawatt hours and kilowatt hours.

Lighting a grid up is only the first step; keeping it lit for the periods that it needs to be lit requires “work” (in the physics sense) from the power generator, and it’s work for which producers charge by the volume hour. Last weekend’s Gridfight post went over the fact that most industrial generation methods have output profiles that don’t match typical consumer peaks and troughs, and how wind and solar generation, which are at the mercy of the elements, don’t match them either.

The solution to leveling out supply and demand on city-scale power grids is often some kind of market. In theory, the prices arrived at by consumers and producers of megawatt hours level out supply and demand. In practice, that works fine, until the market leaves reasonable bounds.

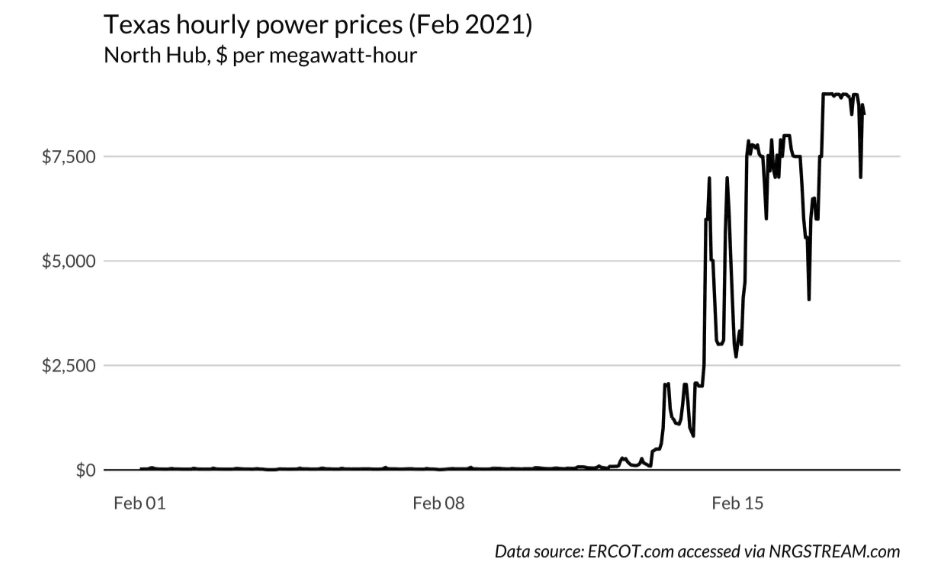

The independent Texas grid’s Wild West approach to energy markets became infamous in the wake of last week’s winter storm, when $9,000+ megawatt hours were being sold to bulk distributors for re-sale to all the consumers they could still manage to reach. The power bills sent to end users are creating a bumper crop in consumer-outrage media this week, but we haven’t yet seen even an inkling that that the cost might be absorbed by the utilities or forgiven.

There are no refunds on generated and consumed electricity. It’s fed to the grid and a consumer can either use it and pay the rate or not. The utility sells it as it’s made, because it’s not like they can just store energy in a big tank and sell it when it’s needed. In fact, they’re at the mercy of the people who can.

The advantage that fossil fuel producers have been able to use to gain and keep a stranglehold on the world’s energy market, even with popular sentiment working against them, is the fact that they are selling stored energy that is available on demand. For the cost of extracting it from geological formations, processing it, and delivering it, the companies who control the dinosaur gas can sell it at the market rate which, during last week’s state-wide emergency, was a very high rate.

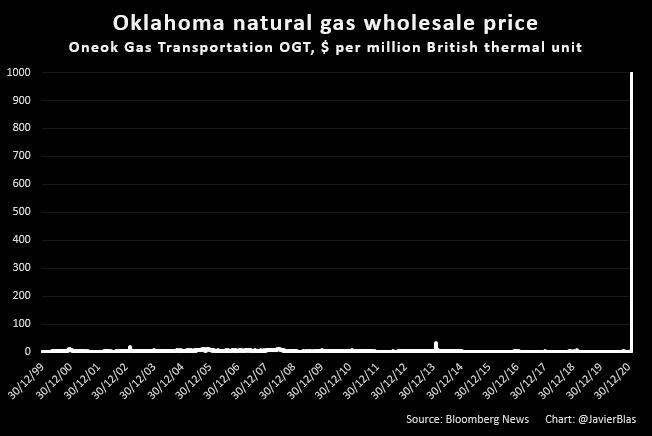

The press has been having a field day with quotes from Comstock Resources Inc.’s (NYSE: CRK) CFO Roland Buns, who was practically giddy as he explained to investors that the Oklahoma-based natural gas producer, whose peers were experiencing production shutdowns because of the cold, was able to use the Texas Snowpocalypse to just soak consumers.

“This week is like hitting the jackpot with some of these incredible prices. Frankly, we were able to sell at super premium prices for a material amount of production.”

Roland Burns – CFO, Comstock Resources Inc.

Comstock surely isn’t the only company that made off like a bandit at the expense of people trying not to freeze to death, because each and every one capable of shipping supply owed it to their shareholders to bank those desperation dollars, but Comstock makes a fine face, because its majority shareholder is Dallas Cowboys owner and convenient rich-guy heel character Jerry Jones.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/UQFJVDEN3WTHU6MAWBVTWVW6O4.jpg)

While fossil fuels’ capacity to be used on demand is the reason consumers can’t kick the habit, their ability to be hoarded is what makes them an attractive investment product. Owners of significant oil and gas reserves are in a position to have great effect on the market by throttling or choking supply to suit their purposes. Smaller reserve bases without as much stroke can at least elect not to sell when the market price isn’t attractive, in-ground reserves having a practically infinite shelf life.

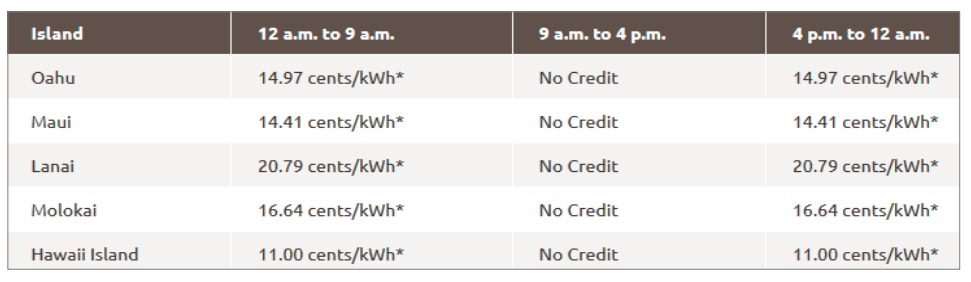

This dynamic puts grids like Texas’ at the mercy of fossil fuel producers, which a fossil fuel producing state like Texas might not consider a problem (but the rate-payers may). Hawaii, on the other hand, which has no petroleum reserves, would much rather make energy from abundant sunshine.

Hawaii is on track to be producing all energy from renewable resources by 2045, thanks to state initiatives that encourage the installation of home solar arrays and battery-storage devices. Hawaii’s net metering policy pays consumers for the power they feed back to the grid, but only in the evenings and at night.

Distributed Storage is the Great Equalizer

If power providers could hoard the energy they produce and sell it to consumers on their own terms, the same way fossil fuel companies do, they would. But they can’t, because of the limits of battery storage.

Battery tech becomes less and less stable the larger the cells get. Small cells that run laptops and cellphones are generally pretty safe, and only catch fire every now and then. But the bigger battery cells get, the less stable they are. Electric car manufacturers have had success building small cells into computer-controlled arrays capable of storing enough power to give decent range to a light car. Battery capacity is improving all of the time, but the present limitations of batteries may be what ends up democratizing energy.

In much the same way that distributed ledgers prevent bitcoin and other cryptocurrencies from being controlled by gatekeepers in finance, distributed, independent storage solutions can keep power from being controlled by gatekeepers in energy. As consumers are going through a reckoning about their need for independence, the units that will allow them to realize it are gaining a strong commercial foothold.

Eguana Technologies (TSXV: EGT) is a small ($139M market cap) company shipping energy storage and grid-integration units that are becoming more relevant all the time. The company makes three energy storage systems, the largest of which is capable of storing 39 KWh of electricity. The systems exist behind the meter, and consist of software, switching, and high-end batteries that manage the comings, goings and storage of electricity for the homeowner, in the homeowner’s interests.

Presently, the units ship with high-tech lithium battery arrays, but as battery tech improves, those batteries can be swapped out for more modern models. As larger industrial companies spend their research budgets trying to out-do each other with battery tech, Eguana has chosen to focus its development on the integration systems, putting it in a position to take advantage of advancing batteries without having to compete in that crowded IP market. Eguana has growing sales profiles in the US and in Europe, driven by strategic partners with dovetailing interests.

Eguana has managed its cap table responsibly, printing only 10 million shares over the past two years. Protecting the equity as the business grew involved taking high interest loans, and other forms of expensive capital. The improved market performance of its stock gave Eguana an opportunity to do a $15 million raise earlier this month, and to force conversion on some debentures.

The money comes just as the world may have finally become ready for Eguana’s particular innovation. Whether it comes from being concerned about their carbon footprint, or a desire to avoid being robbed blind by the power companies, consumers are interested in the behind-the-meter storage solutions that Eguana provides. As more of them are installed, it will become more and more apparent just how much power there is in storing power.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

2 Responses

Didn’t quite dive deep enough. Why wait until the price reaches yearly highs to advise the public. Looks like a big sell off is about ready to hit. Thinking of shorting this … will watch for the momentum to change.

Not sure I follow the question, Merlina. “…to advise the public,” of what?