On its own website, online car dealership Carvana (NYSE: CVNA) promises a “new way to buy a car.” But apparently, no one qualified how the firm would achieve this so-called “new way” as it faces mounting customer complaints and eroding investor confidence.

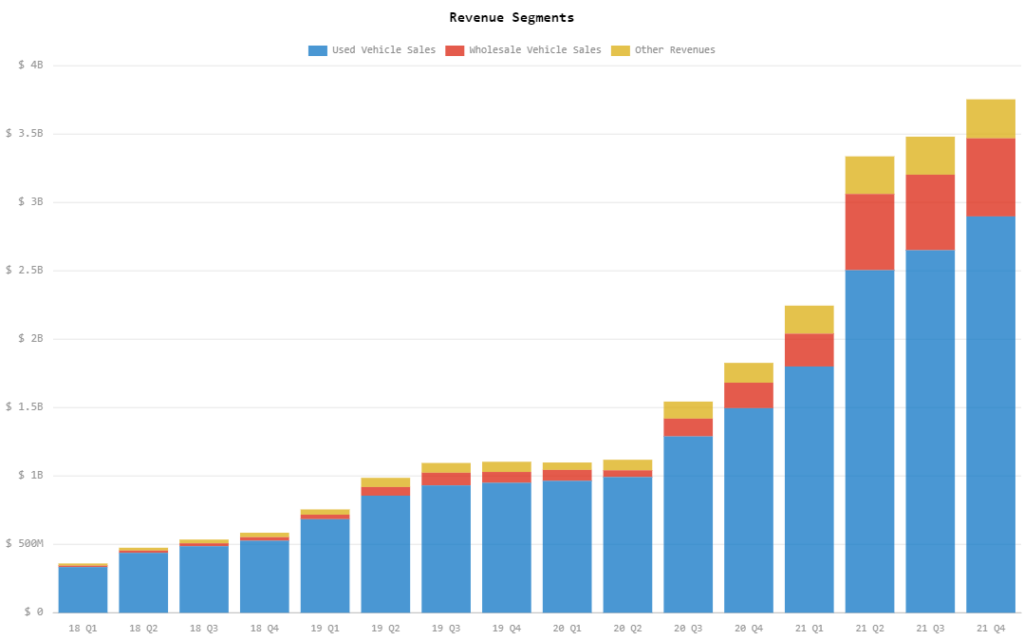

The Arizona-based firm saw its annual revenue more than double in 2021 at US$12.81 billion from 2020’s US$5.59 billion. It sold around 425,237 cars during the year compared to 244,111 vehicles last year.

Total assets jumped to US$4.89 billion from last year’s US$1.92 billion, mainly driven by a US$3.15 billion vehicle inventory from last year’s US$1.03 billion. On top of this, the firm improved its EBITDA loss to US$5 million compared to last year’s loss of US$257 million.

In February 2022, the firm also announced the definitive agreement to acquire the auction business of ADESA, Inc. for approximately US$2.2 billion in cash.

But RBC Capital Markets is not buying the company’s success story. The investment firm downgraded Carvana from Outperform to Perform rating, citing that the exponential growth might not be fit for the capacity expansion.

“Acknowledging a significant discount already priced in, we believe 1) the Adesa acquisition raises the downside risk from any perceived demand shortfall, 2) the second derivative on GPU is inevitably negative (timing uncertain) where Street estimates likely need to come down, and 3) Adesa’s upcoming multi-year integration is likely to be challenging,” the analysts said.

The firm also lowered the price target for Carvana to US$138.00 from US$155.00.

But beyond the financial aspects, the car dealership has been facing mounting reports from disgruntled customers. A Colorado-based buyer said that it took four months after buying the car from the platform before she was provided with the car title – -and it reportedly had 40,000 miles more than what the odometer displayed upon getting the vehicle.

“Which means that I essentially could never resell this car because nobody knows what the correct mileage is or if somebody has rolled the odometer back,” said Sydney Allen, who bought a 2019 Honda Pilot.

While Colorado law requires dealerships to provide car titles within 30 days after purchase, this doesn’t apply to Carvana since it is based in Arizona.

“[We’re] seeing a much more systematic issue with Carvana. That is happening more frequently in more counties, with more cars,” said the state’s head of Revenue Department Mark Ferrandino.

The company takes pride in its speed when it comes to providing vehicles, even providing a delivery service for the car and pick-up option at its “Carvana Vending Machines.”

But another customer reported that after buying a car from the online platform, the vehicle delivered to him had obvious damages that were undisclosed.

“I paid them in full, almost $26,000, and never got any documentation that I own the car–no title, no tag receipt,” said customer James Cunningham.

The firm was fined US$10,000 in Texas related to its issues in paperwork delays while it settled a civil lawsuit in California for US$850,000 for making transactions without the proper licenses.

Carvana last traded at US$113.50 on the NYSE.

Information for this briefing was found via The Denver Channel and Seeking Alpha. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.