There’s a new ticker going around the twittersphere the last few days: Green 2 Blue Energy Corp (CSE: GTBE). The odd thing about this however, is the industry that the firm is involved in. It’s not blockchain. It’s not cannabis. It’s wood pellet production.

Alright, to be fair the wider industry can actually be classified as “renewable energy” if you wish. However, that doesn’t change the fact that the market has seemingly been excited about a centuries old technology. Wood pellets aren’t exactly a glamorous industry, after all. With that being said, demand for the product is actually growing as a result of fossil fuel taxes being implemented in areas such as Canada and Europe.

If one was to actually perform some research on the industry however, they’d quickly realize that the spot price for wood pellets is actually at historic lows. This is according to the Wood Pellet Association of Canada, presumably a reliable source on the matter. This is a result of poor previous forecasting, as well as warmer than average winters for three winters in a row. If interested, you can find more information on the riveting pellet industry here.

So why the sudden excitement for wood pellets? Let’s take a look.

Green 2 Blue Energy: Going Green to Red in Your Portfolio

GTBE’s promotional content

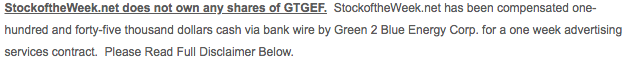

The short of it, is the excitement is a result of some promotional advertising that the company utilized. A service, known as “Stock of The Week”, was used as a means of generating excitement among investors. Much like the traditional promotional emails many traders would sign up for in years past, Stock of the Week works much the same. The company gets paid a fee, and in exchange it sends out an email or text message informing its followers to “buy buy buy”. This generates demand for the equity, and the result is the price goes up.

In this instance, it is identified that Green 2 Blue paid the stock promoter a total of $145,000 USD in exchange for the OTC symbol to be pushed to followers for a week. In short, it’s not investors taking long term positions. Rather, it’s traders capitalizing on volume.

If you’d like to read the full promo, an online version can be found here.

As per a Form 10 filed on thecse.com on April 20th, this agreement was entered into on April 11, 2018. Although more than a week ago, it appears that this promotion has been enacted for an extended period of time.

The justification for the promo

With a price tag of one hundred and forty five thousand, there’s bound to be a reason that Green 2 Blue entered into a promotional marketing campaign. The cover of “brand awareness” doesn’t justify the price tag in this instance, when product is sold in European markets. The answer to this was provided on Friday when the company filed the latest Form 10.

As previously mentioned, this filing identifies that the promotional agreement was entered into on April 11. One day later, on April 12, Green 2 Blue announced that a private placement would be occurring. The financing would occur at a price of $0.30 per unit, with a full warrant at $0.35.

The raise closed over subscribed on April 16 for $4,280,000. Five separate parties were involved in the raise, none of which were stated as being related. The equity climbed to $0.30 on this announcement, only to start a tumble shortly after. As of market close on April 20, Green 2 Blue Energy sat a value of $0.145 per share, half of what the raise was priced at and three pennies shy of the all time low.

If the company was looking to pad it’s bank account, the promotion was on overwhelming success. For shareholders however, it served as another example of why proper due diligence is crucial.

Information for this analysis was found via Wood Pellet Association of Canada, Stock of the Week, The CSE, and Green 2 Blue Energy Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

Understanding Cheque Swaps

If you are investing in cannabis stocks or stocks in general in Canada, a term...