K92 Mining (TSXV: KNT) this evening released the results of a preliminary economic assessment (PEA) conducted on its Kora gold deposit, which is part of the deposit that forms the firms Kainantu Gold Mine project in Papua New Guinea. The study, which indicates an after tax net present value of US$1.5 billion at US$1,500 gold, has resulted in the company proceeding to a definitive feasibility study for the Kora Stage 3 expansion.

Within the study, it was found that an average annual expansion run-rate production of 318,000 ounces of gold equivalent is feasible, at an all in sustaining cost of US$489 per ounce and life of mine average costs of US$353 per ounce of gold equivalent.

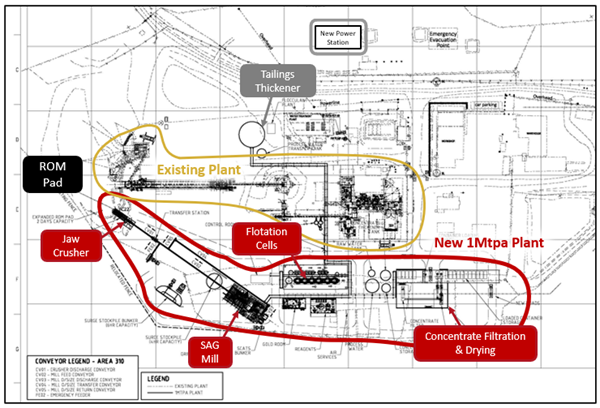

Initial pre-expansion costs are expected to total out to US$125 million, while life of mine sustaining capital costs are estimated at US$341 million. All capital costs are said to be fully funded from cash flow from the existing Kainantu mine, currently operating at stage 2. The mine overall is expected to have a life of 12 years for the third stage, with the third stage said to include an expansion to underground mining along with on-site treatment of mine material, including milling, gravity and flotation recovery via a 1 million tonne per annum processing plant..

Gold production from the mine over the course of its 12 year life is estimated at 2,642,000 ounces, along with 4,248,000 ounces of silver and 195 million pounds of copper. Annual production as a result is estimated at 220,000 ounces, 354,000 ounces and 16 million pounds, respectively, with production anticipated to ramp up following the stage 3 completion of the project, which is estimated to occur in 2024. The average grade of all processed material is estimated at 10.4 grams per tonne equivalent.

The Kora mineral deposit, as of April 2, is currently estimated to have a mineral resource of 1.1 million ounces of gold equivalent, at an average grade of 10.45 grams per tonne, which is based on a 1.0 gram per tonne cut-off. Further exploration on site remains underway via four operational underground drill rigs, as well as three surface drill rigs, which is expected to expand to five by year end.

While the net present value of US$1.5 billion is based on US$1,500 per ounce gold, that figure balloons to US$2.0 billion at US$1,900 per ounce gold – demonstrating why the rising price of the precious metal is so important to gold operations globally.

K92 Mining last traded at $5.64 on the TSX Venture. Full details on the preliminary economic assessment can be found here.

Information for this briefing was found via Sedar and K92 Mining. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.