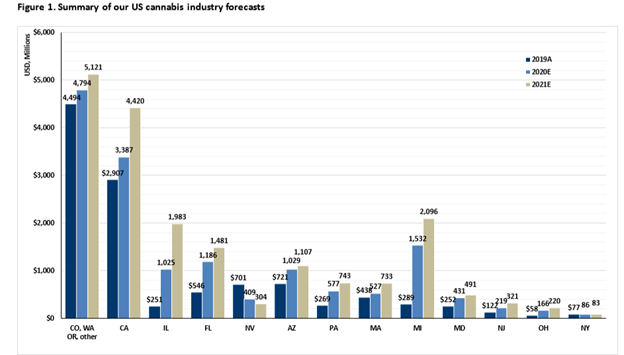

Earlier this week, Stifel released a new report on cannabis operations, focused predominantly on US-based multi state operators, while re-initiating covering on several issues. Within, Stifel projects sales from already legal states to have a compound annual growth rate of ~30% over the next three years to reach ~U$25 billion. The firm calls US Cannabis an “attractive investment opportunity” for that reason.

Stifel also makes note that US Cannabis, “provides investors with exposure to strong growth trends that are secular, mostly unaffected by global trade dynamics” They also make note that Arizona and New Jersey recreational cannabis markets could offer a US$1.0 billion upside to their current FY2021 forecasts.

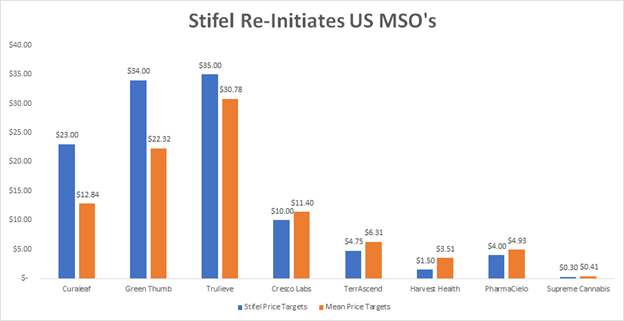

Stifel re-initiated six multi state operators, one Canadian cannabis company, and a Colombia operator. Out of the eight, they issued one speculative buy, five buys, and two hold ratings. Below are the individual price targets and ratings.

- Re-initiates Curaleaf (CSE: CURA) with a Buy rating and a C$23.00 price target

- Re-initiates Green Thumb Industries (CSE: GTII) with a Buy and a C$34.00 price target

- Re-initiates Trulieve (CSE: TRUL) with a Buy and a C$35.00 price target

- Re-initiates Cresco Labs (CSE: CL) with a Buy and a C$10.00 price target

- Re-initiates TerrAscend (CSE: TER) with a Buy and a C$4.75 price target

- Re-initiates Harvest Health (CSE: HARV) with a Hold and a C$1.50 price target

- Re-initiates Supreme Cannabis (TSX: FIRE) with a Hold and a C$0.30 price target

- Re-initiates PharmaCielo (CSE: PCLO) with a Speculative Buy and a C$4.00 price target

In the note, Stifel calls Curaleaf “the only true national US cannabis compan,y” re-initiating Curaleaf with a C$23 price target and a Buy rating. They have FY2020 and FY2021 revenue estimates of $674.9 million and $1,327.7 million respectively.

Stifel states that Curaleaf has developed this national presence organically. Without any canceled or favorably restructured terms on their more significant acquisitions, they attribute this to Curaleaf’s chairman, who has experience with rolling up distressed and highly regulated industries. They then go on to say that if recreational conversion happens in Arizona and New Jersey, it could add between $2.50- $5.00 a share, which presents an upside that is not factored into their current estimates and significant catalysts for the company.

Moving onto Green Thumb, Stifel says its “Best-in-class operational execution,” saying that the company has leveraged financial discipline to spend cash to find the largest ROI opportunities; because of this, it has excellent platforms in limited-license medical and recreational states which is a competitive advantage Stifel notes.

Stifel re-initiates Green Thumb with a C$34 price target and a buy rating, giving FY2020 and FY2021 revenue estimates of $480 million and $710.1 million, respectively, while indicating that for the last five quarters Green Thumb has outperformed analysts’ expectations. Stifel believes that won’t change this quarter either, stating that the analyst consensus for Q2’20 is low due to the ban on recreational cannabis sales in Massachusetts and the lockdowns causing less tourism, alongside the delivery-only model in Nevada. They take the contrarian view and say that the strong growth seen in Illinois, Maryland, and Pennsylvania could offset the weakness in Massachusetts and Nevada.

Next is Trulieve, which Stifel calls “The most profitable public US cannabis company,” saying that they are in a great position to capture opportunities with is ~$100 million cash balance. Stifel re-initiated Trulieve with a C$35.00 price target and a Buy rating, giving revenue estimates for FY2020 and FY2021 of $459.2 million and $571.5 million, respectively.

Stifel also believes that the Q2 and FY20 consensus is too low, saying that they expect Trulieve to beat analyst expectations for a 7th straight quarter. They extrapolate Florida Department of Health data and say that Trulieve can potentially generate Q2 sales of $117 million, up 20% quarter over quarter, and above the consensus of $105 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.