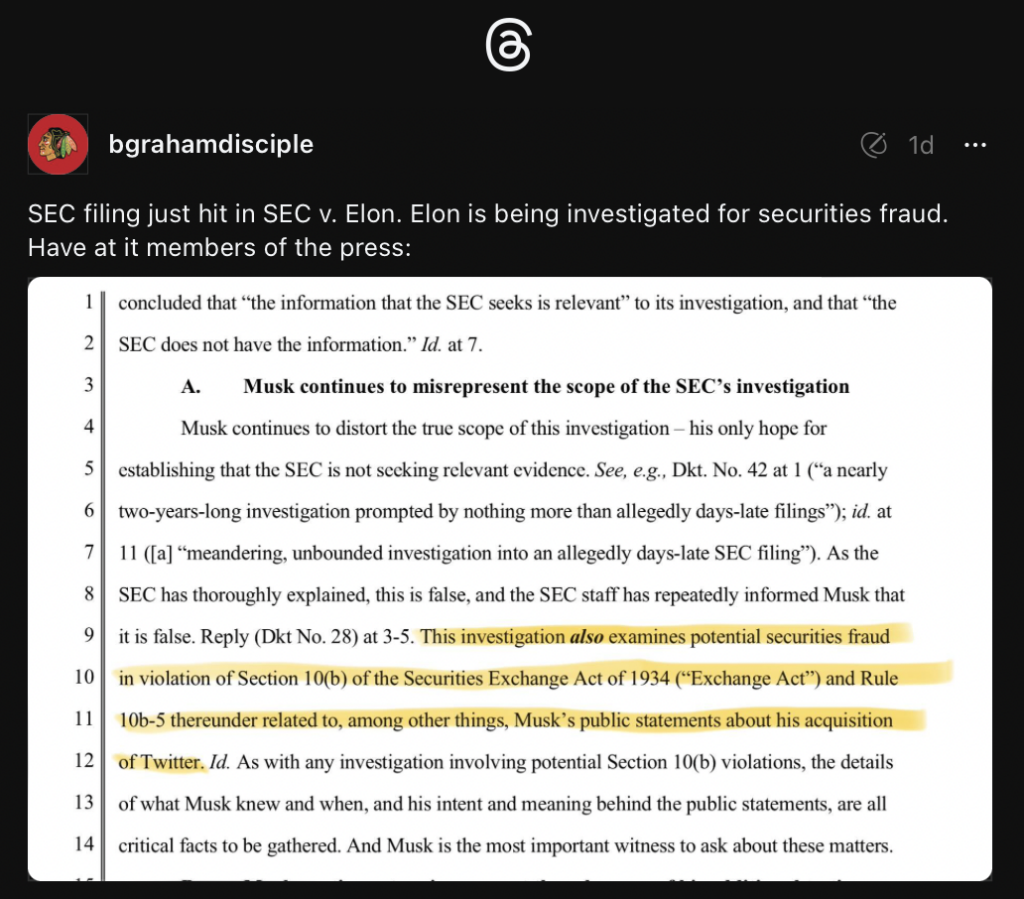

The US Securities and Exchange Commission (SEC) has leveled fresh accusations against Elon Musk, the billionaire CEO of Tesla and SpaceX, in an ongoing investigation concerning his acquisition of Twitter. In a new filing on Wednesday, the SEC accused Musk of attempting to delay and misrepresent the scope of its investigation into potential violations of federal securities law.

“Musk continues to distort the true scope of this investigation – his only hope for establishing that the SEC is not seeking relevant evidence,” the agency said in its suit. “As the SEC has thoroughly explained, this is false, and the SEC staff has repeatedly informed Musk that it is false.”

The investigation into Musk’s actions dates back to 2022, focusing on his failure to promptly disclose a significant stake in Twitter before initiating his bid to acquire the social media platform on April 14th of that year. Despite testifying twice in 2022, Musk has since resisted the SEC’s efforts to schedule a third and final interview, with the regulator alleging that he has persistently raised baseless constitutional objections against testifying.

A significant development in the case occurred on February 10th when a federal judge ordered Musk to cooperate with the SEC’s investigation. The judge stipulated that if the parties failed to agree on a date and location for Musk’s testimony within a week, the decision would be imposed upon them.

However, as of the latest filing, the testimony has not taken place, with the SEC accusing Musk of employing delay tactics to hinder the progress of the investigation.

The SEC’s filing contends that Musk has engaged in “gamesmanship” to impede the completion of the investigation, highlighting his efforts to delay proceedings since April 2023. Despite Musk’s recent complaints about the prolonged duration of the investigation, the SEC argues that it was his own tactics that extended the process from one year to almost two.

Of particular interest is the mention in the SEC filing of Walter Isaacson’s biography on Musk, which the commission claims contains “important new information” relevant to the investigation. Notably, the biography was published just three days before Musk failed to appear for testimony in September 2023. This same biography is also referenced in a lawsuit filed by former top Twitter executives whom Musk dismissed shortly after acquiring the company.

“Neuralink’s device killed monkeys”

Compounding the legal kerfuffle Musk is facing with the SEC, a prominent national physicians group has called upon the commission to launch an investigation into the billionaire for potential securities fraud. The move comes in response to Musk’s recent statements regarding the deaths of monkeys involved in experiments at his brain-computer interface company, Neuralink.

During the DealBook Summit hosted by The New York Times on November 29th, Musk made assertions about the circumstances leading to the deaths of monkeys subjected to surgical procedures at Neuralink. Musk claimed that the animals “had a terminal case of cancer or something like that” before undergoing surgeries, including the implantation of devices into their skulls.

However, the Physicians Committee for Responsible Medicine, which obtained nearly 600 pages of veterinary records through legal action, refutes Musk’s claims. According to the committee, none of the 12 monkeys that died following the surgeries had terminal diseases, as suggested by Musk.

The Physicians Committee argues that Musk’s statements regarding the health risks associated with Neuralink’s invasive implants are misleading investors about the safety and marketability of the company’s product. This latest plea to the SEC follows a similar request made by the committee in September, after Musk allegedly made misleading statements on social media platform X, asserting that no monkey had died as a result of a Neuralink implant. In November, four U.S. lawmakers also urged the agency to investigate the matter.

If the SEC decides to take action, it would not be the first time Musk has faced regulatory scrutiny for misleading investors. In 2018, he was charged by the SEC for a series of false and misleading tweets regarding Tesla’s potential privatization.

Contradicting Musk’s recent claims, Neuralink issued a statement in February 2022 detailing the circumstances surrounding the euthanization of six monkeys following surgeries conducted at the University of California, Davis, between 2017 and 2020. The deaths were attributed to various factors, including suspected device-associated infections, device failure, and complications arising from the use of surgical adhesive.

One particularly distressing incident involved a rhesus macaque identified as “Animal 21,” whose deteriorating health was linked to the use of BioGlue, a surgical adhesive, during the procedures. Veterinary records revealed severe health complications, including brain swelling, paralysis, and ulcers, ultimately leading to the animal’s euthanization.

The Physicians Committee highlights concerns raised by medical experts regarding the safety risks associated with highly invasive devices like Neuralink’s. The group has called for an end to Neuralink’s animal experiments and urges the company to focus on developing noninvasive brain-computer interfaces instead.

Ryan Merkley, director of research advocacy with the Physicians Committee, emphasizes the gravity of the situation, stating, “Neuralink’s device killed monkeys, raising serious questions about whether it is unsafe and dangerous to patients.” Merkley accuses Musk of deliberately misleading investors and the public by providing false information about the company’s experiments.

While reports indicate that the U.S. Food and Drug Administration approved Neuralink for limited human clinical trials in May 2023, the fate of the company’s product remains uncertain amid mounting controversies and regulatory scrutiny.

These developments come on the heels of Musk of a lawsuit where a stockholder plaintiff has successfully argued that the billionaire was overpaid through an exorbitant performance-based equity-compensation plan amounting to a maximum value of $55.8 billion. The post-trial decision holds that Tesla’s directors breached their fiduciary duties in approving Musk’s compensation, raising questions about the fairness and transparency of the process.

Market cap of $TSLA now low enough were 1/3rd of the infamous CEO Comp Options would never have been earned in the first place. Few of the letter writers to McCormick probably referenced this fun fact.

— Rob Schmied (@rschmied) March 14, 2024

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.