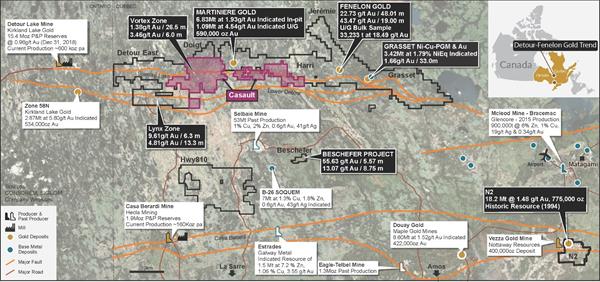

Wallbridge Mining (TSX: WM) announced a significant development this morning, with the firm entering into an option agreement to acquire a 65% interest in the Casault gold property from Midland Exploration (TSXV: MD). The news is significant in that the property is contiguous to two of Wallbridge’s properties in the Detour-Fenelon gold trend.

The acquisition of Casault brings together the Detour East gold property with that of the Martiniere property, enabling the company to unit its properties seamlessly. Combined, Wallbridge now has control over 900 square kilometres of exploration property in the Northern Abitibi Greenstone Belt.

The new property consists of a total 322 land claims approximately 40 kilometers east of the Detour Lake gold mine. The new property is approximately 177 square kilometres, and hosts the the Vortex zone, which has graded up to 1.38 grams per tonne gold over 26.5 metres, with the zone being at least 1.5 kilometres long.

The property can be acquired up to 65% through the execution of two separate option agreements. The first outlines a path to 50% ownership, which includes aggregate expenditures of $5.0 million by June 30, 2024, along with aggregate cash payments of $600,000 by June 30, 2024 directly to Midland via a series of installments.

The second option agreement, good for an additional 15% of the property, requires additional expenditures or cash payments of $6.0 million within two years of the first option being fully exercised. The form of payment is at the discretion of Wallbridge.

Wallbridge Mining last traded at $1.03 on the TSX.

Information for this briefing was found via Sedar and Wallbridge Mining. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.