On May 31, Western Copper and Gold Corporation (TSX: WRN) announced that mining giant Rio Tinto funded a $25.6 million investment in Western. Rio acquired 11.8 million shares in Western and now owns an 8.0% stake. The investment will reportedly allow Western to advance its promising copper-gold Casino Project in west-central Yukon.

Probably more important, the scale of Rio’s investment and its resultant ownership stake in Western suggests that if the Yukon project were to be successfully developed, positioning it to be a significant copper-gold producer, Rio could at some point be interested in acquiring the whole company. Many junior miners have ultimately been acquired by a larger mining company which had a substantial baseline ownership position in the smaller mining entity.

Rio’s ownership stake is structured as just such a baseline investment. For example, as part of its agreement with Western, Rio has agreed not to dispose of any of its shares and to vote its shares in favor of all Western’s Board of Director nominations. In addition, if Rio’s ownership stake increases to 12.5%, it can appoint one member to Western’s Board.

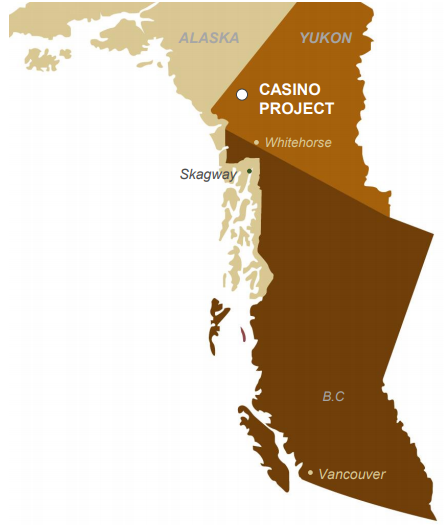

Western’s Casino Project – Potentially a Giant Mine

According to a mid-2020 Mineral Resources Estimate, Casino contains, on a measured and indicated basis, 14.5 million ounces of gold, 113.5 million ounces of silver, and 7.6 billion pounds of copper. We do note that Casino is not a high-grade resource; the gold present has an average grade of only 0.19 grams of gold per tonne of resources.

Western hopes to complete both a preliminary economic assessment (PEA) and a feasibility study update on Casino in 2021.

The Governments of Canada and Yukon have committed a combined $130 million of funding to build an access road to the Casino Project. Construction of the initial portion of the road could begin this year.

Solid Cash Position

Factoring in Rio Tinto’s $25.6 million investment and Western’s $27.7 million in cash, short-term investments and marketable securities as of March 31, 2021, the company’s current cash position probably exceeds $50 million. Western has no debt.

A pre-revenue company, Western has controlled its cash outlays reasonably well. Its operating cash flow shortfall was about $1.5 million in 1Q 2021 and has averaged approximately $750,000 over the last five reported quarters.

| (in thousands of Canadian $, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($1,097) | ($804) | ($633) | ($551) | ($757) |

| Operating Cash Flow | ($1,469) | ($676) | ($644) | ($557) | ($493) |

| Cash & Short Term Investments | $27,685 | $29,384 | $3,294 | $6,165 | $2,918 |

| Debt | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 135.8 | 135.6 | 115.7 | 114.7 | 110.6 |

Despite Rio’s investment and implied vote of confidence in the Casino Project, the project will not become a producing mine for a number of years. Consequently, any potential takeover activity for the company may not occur for a lengthy period as well.

Rio’s long-term investment in Western may be considered an affirmation of the solid prospects for the company’s Casino Project. As Western develops this resource and publishes a PEA and updated Feasibility Study, investors seem likely to grow more comfortable with the company. This could translate into continued improvement in Western’s stock market valuation.

Western Copper and Gold Corporation last traded at $3.01 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.