Identillect Technologies: Some Quick Highlights

Identillect Technologies Corp (TSXV: ID) is perhaps one of the most unknown blockchain developing companies on the market right now. Which is unfortunate, as it enters the emerging market with a tech background unlike many of its competitors. At the current point in time, many entering the blockchain space have minimal if any history of being in the tech space. And then there’s Identillect, an award winning security-focused company that is relatively unknown within the sector.

Identillect Technologies is a company rooted in providing security solutions to companies of all sizes. They identify themselves as providing a product that is easy to manage by both small shops and large enterprises alike. Their primary product of which, is email security. The company offers an easy to use multi platform plugin that encrypts the data being transferred through email, reducing the likelihood of security breaches. Recently, it entered the blockchain sector as a means of further enhancing their security related product offerings.

As a relative unknown in the sector, lets take a quick dive into Identillect to show what they have to offer to the market.

Identillect Technologies: Some Quick Highlights

The company has excellent gross margins

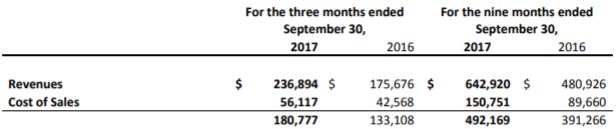

The very first item that stood out to us in regards to Identillect Technologies, is the gross margins that the company is posting. They are exceptional, and show great potential for the future of the company.

For the period ended September 30, 2017 Identillect Technologies posted gross margins of 76.31%. For the nine month period, this figure was marginally higher at 76.55%. Overall, this shows that this gross margin figure will continue to be consistent. The main costs listed under the cost of sales includes product support as well as sales commissions for the product. With it being a technological product, little other inputs are necessary under this heading.

Although the company posted a loss for both the three and nine month period, it shows the potential that exists for the company in the future. Once it can gain momentum with its revenues, the associated expenses will quickly fall prey to economies of scale and thus drop off.

Identillect has focused on aligning itself with associations

Arguably, Identillect has spent its marketing and promotional dollars in the most effective way possible for their product. They’ve elected to target associations and organizations. What’s the significance of this?

This is significant for one key reason – trust. Individual members of associations, such as doctors and lawyers, trust the regulatory bodies and associations that they are members of. These individuals are more often than not highly regarded experts in their specific field of study. However, when it comes to internet security they frequently know little on the topic. Rather they know that they need to keep their information secure for both themselves as well as their clients. In these instances, they turn to their associations for guidance on the matter.

That’s where Identillect’s partnerships come in. As being the highly recommended security product by these associations, its an easy sale for the company – especially with the price points that they sell their products as. Let’s take a look at some of the organizations and associations that Identillect has secured this preferred vendor status with.

- Smile Savvy Inc – A leading internet marketing firm for pediatric dentists. The firm currently has roughly 1,500 clients across the US, as well as members in a total of six countries globally. Currently, they provide email services among other items for their clientele.

- Arkansas Bar Association – An association consisting of roughly 7,000 members within the specific profession of law. An industry highly focused on email security, this is an easy fit for the company. Although it has 7,000 members, this does not include the team members that support such individuals that will also require the same degree of email security.

- Community Dental Partners – An association focused on providing guidance, technology, and resources to dentists across the United States.

- Community Support Network Inc – A not for profit focused on providing services to those with developmental disabilities.

Further to securing the preferred vendor status at these associations, it should be stated that all of these agreements have occurred within the past two months. As such, it is expected that the revenues of Identillect should begin to ramp up shortly with the additional clientele gained from these initiatives.

QubeChain and Identillect’s partnership

One beneficial relationship that Identillect Technologies has formed is with that of QubeChain LLC. The relationship with the blockchain developer began when the firm initiated Identillect for their email security services in early December 2017. Given QubeChain’s intent to apply blockchain technologies across all industries, a natural partnership shortly emerged.

Within two weeks, it was announced that the two firms had come together to create a form of multi factor authentication. Utilizing blockchain infrastructure to establish the technology, the product will in the future be marketed alongside Identillect’s current suite of security products as another means of enhancing user security. Multi factor authentication is a secondary form of verifying a user and creates an added layer of security to systems.

In addition to the MFA initiative being undertaken as a joint measure, QubeChain is also looking to further promote the benefits of Identillect’s products. To do so, they have established themselves as a reseller of Delivery Trust, the flagship product suite created by Identillect. To this end, QubeChain is currently on-boarding over 100 sales personnel to sell the product. The primary target market will be that of medical professionals through QubeChain’s medical division. Currently, the company has access to a large Accountable Care Organization. This ACO is made up of eleven groups, which each have a member count ranging from 50,000 to 240,000. In short, its a highly expansive network that currently holds massive potential.

It is not clear what terms this reseller agreement consists of at this point in time.

Regulatory requirements are working in Identillect’s favour

This last item will be of major benefit to Identillect. Regulatory requirements are being instated in May 2018 across the European Union that requires stronger encryption of consumer data. Known as the General Data Protection Regulations (GDPR for short), the intention is that individuals will have greater control over their personal data. Within the regulations is stiff fines for any company that is subject to a data breach that does not have encrypted information.

This in turn is a perfect fit for data contained on a blockchain due to the inherent security of such a process. Combined with the encryption features that are currently embedded in Identillect’s suite of products, it’s a winning combination for the company.

As a result of these regulations being implemented in a few short months it is expected that the demand for such products will skyrocket in the near term. Coupled with the fact that Identillect’s products are sold on a recurring fee basis it makes for an excellent business case.

Closing Remarks

In short, we currently like what we see coming from Identillect Technologies. Although it is utilizing blockchain technology in several different areas, we like that the company doesn’t seem to be exploiting this buzzword. This is an all to uncommon item in the current market landscape.

In addition to using blockchain, the company itself has a solid suite of product offerings. The several add on products available such as Secure Scan and ESign are easy margin enhancers that provide further profitability. Further to this, the fact that these products are available across numerous platforms is an added benefit that is not often seen in the field.

Provided that significant sales are generated from the recent agreements put in place, Identillect may be well on its way to profitability. For a small cap stock, that’s impressive.

Find the undervalued companies differentiating themselves from the market. Dive Deep.

Information for this analysis was found via TMX Money, SEDAR, and Identillect Technologies Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.