Amazon.com Inc (NASDAQ: AMZN) reported its second quarter financial results on July 29. The company did not continue the earnings beat like its counterparties reported this quarter. The company reported top-line revenue of $113.08 billion, coming in below the $115.14 billion consensus estimate. Revenue grew 27.2% year over year and gross profit grew 34.9% year over year to $48.9 billion. Gross margin came in at 43.2% and operating margin was only 6.8% for the quarter. The company’s net income was $7.77 billion and earnings per share came in at $15.13.

Analysts have had mixed feelings about the results, resulting in the consensus 12-month price target dropping to $4,171.76 from $4,264.77 from before the results were released. Susquehanna Financial has the street high at $5,000 while the lowest 12-month price target comes in at $3,775. Out of the 53 analysts covering the stock, 20 have strong buy ratings, 31 have buys and 2 analysts have hold ratings.

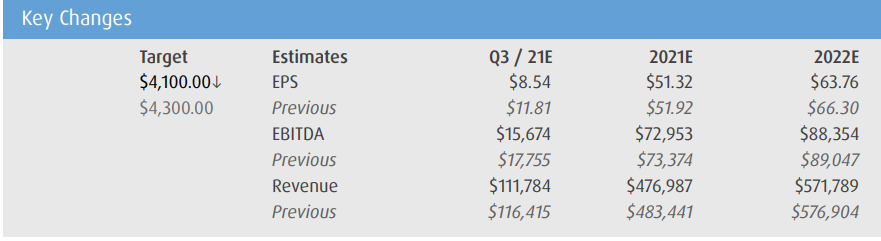

BMO Capital Markets lowered their 12-month price target on Amazon to $4,100 from $4,300 and reiterate their outperform rating, saying that the company had much tougher comps this quarter than other tech companies.

Amazon’s total revenue of $113.1 billion was behind BMO’s estimate of $113.6 billion, but Amazon beat every single business segment, except for online stores. Amazon’s executives explain on the call that there was slower growth in the online space due to lockdown restrictions easing and people spending money on those things rather than online. BMO says that third-quarter guidance also of $106-$112 billion came in a lot lower than their $116 billion estimate.

BMO Capital Markets says that they are left with a few final thoughts coming out of the call, including that AWS growth remains consistent at 30% and that Amazon, “remains at the center of the two most important growth segments in digital advertising: retail media (e.g. Sponsored Product ads) and connected TV.”

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.