Canacol Energy Asserts It Will Be Able To Pay Its Next Coupon

Amid growing concerns among investors, Canacol Energy Ltd. (TSX: CNE) has moved to reassure stakeholders regarding its debt obligations.

In a statement, Canacol emphasized its compliance with all debt covenants, citing its consolidated leverage ratio of 2.85x as of December 31, 2023, well within the parameters set by its covenants with the issued senior notes (3.25x) and the revolving credit facility (3.50x).

“Any speculation that the Corporation may not be paying its next coupon is completely false and Canacol reaffirms its commitment to meet all its future financial obligations,” the company stressed.

The firm highlighted its recent corporate restructuring, anticipating a reduction in tax expenses for 2024 and beyond, thereby enhancing liquidity for debt management, including the potential repurchase of senior notes.

In the latest financial statements, the company’s current asset balance landed at $151.6 million while current liabilities ended at $164.9 million. Cash and cash equivalents balance came in at $39.4 million, down from $58.5 million at the beginning of the year. The current cash reserves are only marginally above the amount required to meet upcoming coupon payments due in May and November.

This is exacerbated by the firm ending up with $86.2 million in annual net income, a drop from last year’s $147.3 million.

The development comes after Canacol announced the discontinuation of its quarterly dividend. This decision, outlined in a previous press release, is expected to provide immediate benefits in terms of balance sheet flexibility and cash liquidity.

“Since initiating that dividend in late 2019, we paid out approximately $118 million over 17 quarters amounting to an aggregate of C$4.42 per share. However, it is now clear, in our view, that discontinuing the dividend in order to increase balance sheet flexibility and cash liquidity in the short term is in the best long-term interest of all stakeholders,” CFO Jason Bednar elaborated on the earnings call.

Amid gas scarcity in Colombia, Canacol remains optimistic about its financial outlook. The corporation anticipates generating between $250 million to $290 million in EBITDA during 2024, against the reported EBITDA of $237 million for 2023.

To further shore up its financial position, Canacol plans to prepay its 2024 tax installments in the first half of the year, with reduced cash requirements anticipated in the latter part of 2024 and into 2025.

The company also indicated potential divestment of its Arrow Exploration Corp stake and the utilization of a short-term credit facility if necessary.

Backing its financial strength, Canacol highlighted its robust reserves base, boasting 295 Bcf in the proved category and 607 Bcf in the proved plus probable category as of December 31, 2023. Additionally, the corporation disclosed 161 Bcf of Proved Developed Not Producing reserves, signaling potential for future production growth.

“People are not happy”

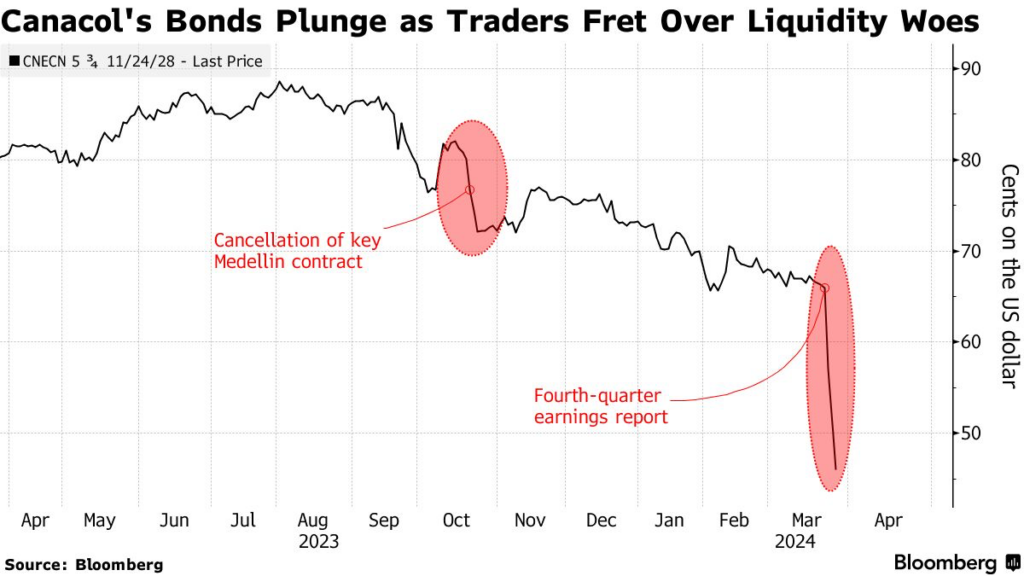

However, investors are showing growing apprehension towards the firm, with the company’s bonds taking a significant hit as notes maturing in 2028 plummeting by as much as 20 cents on the dollar over just three days to reach fresh lows of about 46 cents.

The recent downturn has exacerbated a six-month decline in Canacol’s bond prices, which started in October following the cancellation of a crucial pipeline contract in Medellin. Despite management’s assurances of considering asset sales and establishing a new credit facility, investor concerns persist.

“People are not happy with the sudden U-turn with the pipeline last year, while some shortfalls and output and operational hiccups are not helping sentiment,” said Eduardo Ordonez, a portfolio manager.

Canacol reported a decrease in output coupled with a 37% rise in net debt to $674 million by the end of 2023 compared to the previous year. Furthermore, BancTrust & Co. highlighted a concerning drop in the replacement ratio for proven and probable reserves to a “meager” 31%.

Despite debt-to-earnings ratios remaining below covenant triggers, Canacol’s bonds have incurred losses exceeding 20% over the past three months, marking the poorest returns in Latin America, as indicated by a Bloomberg index. Meanwhile, other energy companies in Colombia have largely outperformed the market during the same period.

With the next coupon payment looming on May 24, valued at $14.4 million, Canacol is expected to navigate upcoming financial obligations smoothly, according to Lucror Analytics. However, analysts caution that the depletion of liquidity and deteriorating reserves pose significant challenges for Canacol in 2024.

“This sets up 2024 to be a much trickier year for the company in our view, leaving no room for error unless the company can secure other lines of credit,” said JPMorgan Chase & Co. analyst Alejandra Andrade.

Canacol Energy last traded at $4.51 on the TSX.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.