Faster than its accumulation of the digital asset, Tesla (Nasdaq: TSLA) just liquidated around three-quarters of its bitcoin holdings, a perceived departure from the company’s staunch embrace of the crypto coin.

“As of the end of Q2, we have converted approximately 75% of our Bitcoin purchases into fiat currency,” the company said in its Q2 2022 earnings update.

$TSLA #Bitcoin pic.twitter.com/v0vkjhRJrs

— The Dive Feed (@TheDeepDiveFeed) July 21, 2022

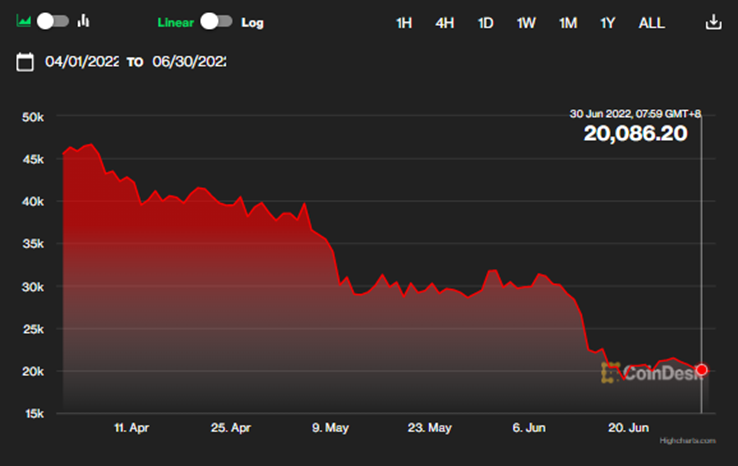

The company said the sale generated around US$936 million cash for the quarter but did not disclose the timing of the bitcoin dump. The second quarter saw bitcoin decline from around US$45,500 down to US$20,100 at the end.

CEO Elon Musk however clarified that the sale “should be not taken as some verdict on bitcoin” as he signified that the company is still open to buying more crypto in the future.

“The reason we sold a bunch of our bitcoin holdings was that we were uncertain as to when the Covid lockdowns in China would alleviate so it was important for us to maximize our cash position,” Musk said in the Q2 2022 earnings call.

The US$936-million bitcoin sale is also the main driver of the firm’s quarter-on-quarter increase in cash and cash equivalents balance by US$902 million. Digital assets on the balance sheet dramatically shrunk during the quarter as a result, to US$218 million from last quarter’s US$1.26 billion.

Musk has a confusing relationship with bitcoin, with each change affecting the crypto asset’s price. After Tesla’s chief executive announced the company’s massive bitcoin investment in February 2021, Musk doubled down in expressing favor for the crypto asset.

“Having some bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P 500 company,” Musk then tweeted. The move pushed bitcoin to its US$1-trillion market cap mark.

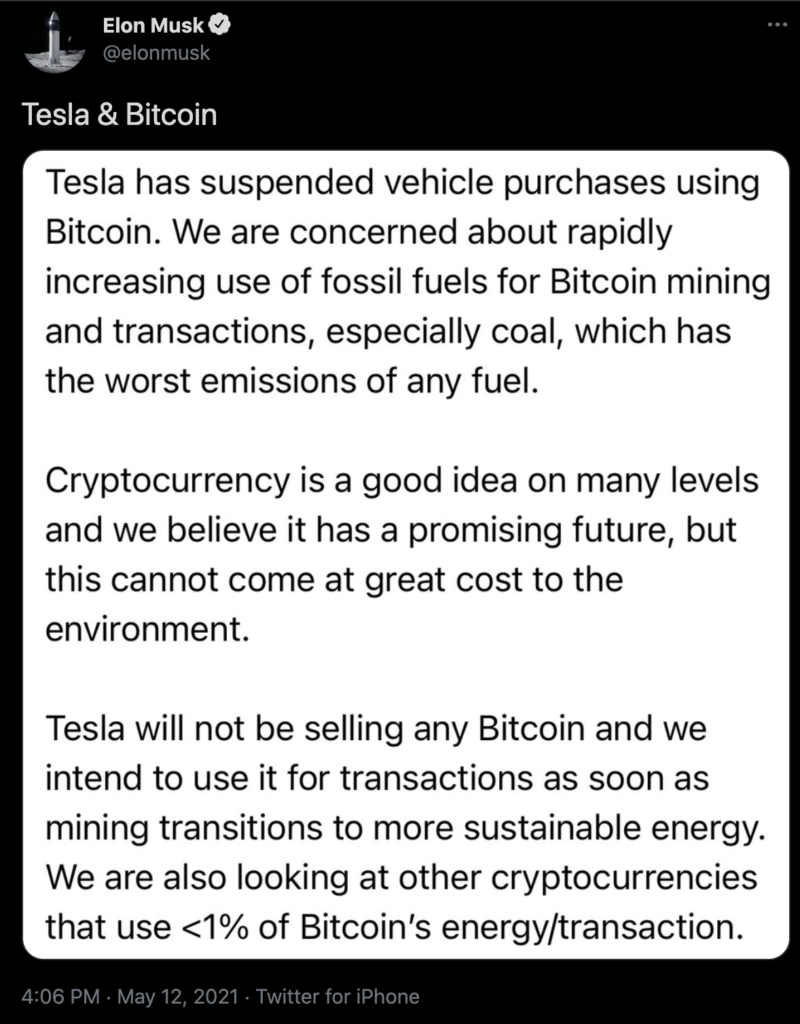

But then, come May 2021, Musk said that the company would stop accepting bitcoin payments at Tesla dealerships over concerns about the crypto asset’s environmental impact. The comments triggered a US$365 billion bitcoin selloff.

Musk’s succeeding tweet provided color on his attitude towards bitcoin investing.

Credit to our Master of Coin

— Elon Musk (@elonmusk) May 19, 2021

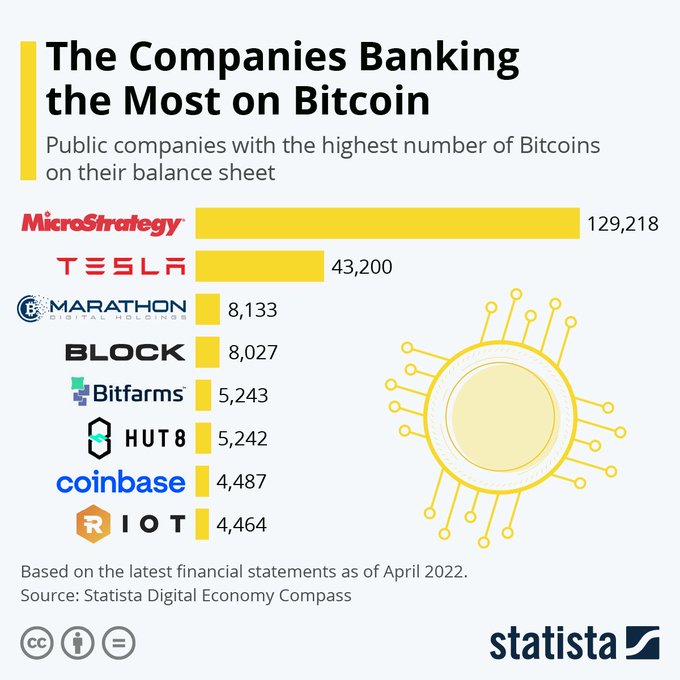

The sale contrasts with the US$1.5-billion investment in bitcoin the company made in February 2021, making Tesla the second-biggest public company holder.

“We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash,” the company said at the time of the purchase. The bitcoin value then traded around US$34,000.

In that same quarter, the firm sold around US$272-million worth of bitcoin when the price hit the US$50,000-mark.

Now, the digital coin is sustaining massive losses from a series of factors stemming from the whiplash of the rising inflation. As the bitcoin price slumped during Q2, it is estimated that the automaker will record an impairment loss of around US$500 million.

In its Q2 cash flow statement, the firm recorded a cash burn of US$922 million from depreciation, amortization and impairment. However, it wasn’t specified how much of the impairment was the result of bitcoin’s devaluation.

Tesla last traded at US$742.50 on the Nasdaq.

Information for this briefing was found via CNBC the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.