As the coronavirus pandemic continues to deepen, plunging the world economy into a despair of towering debt via continuous central bank stimulus and quantitative easing, it really makes one wonder how has the financial system made it this long – without completely and utterly collapsing? Well, the analogy of “fighting fire with fire” certainly comes to mind, but to make it more befitting to this disastrous situation, replace “fire” with “debt” and you’ve got yourself the problem and solution all in one simple step.

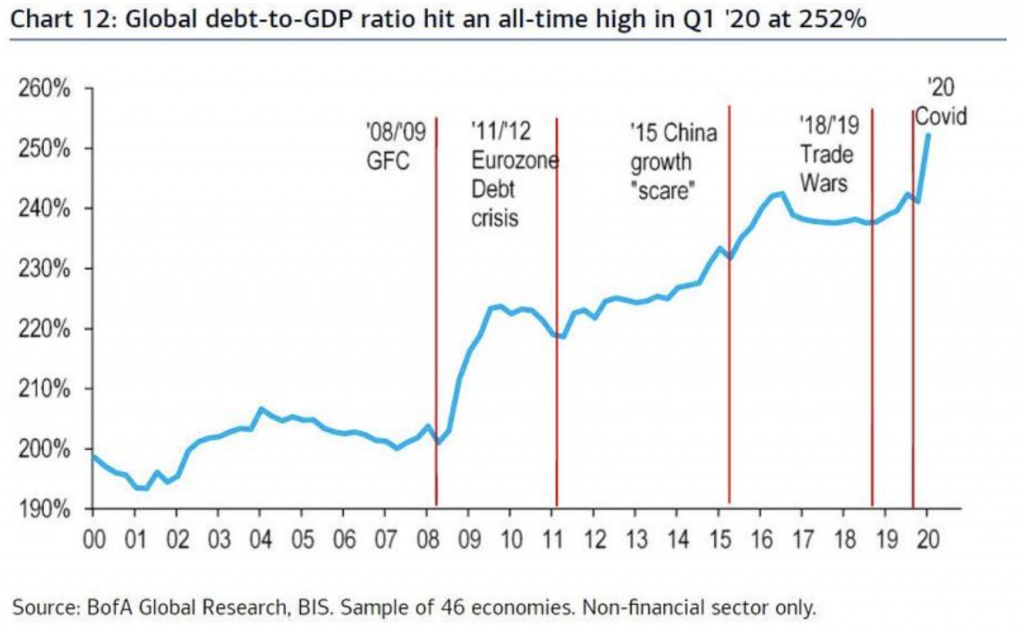

Long before the onset of the pandemic, the world was already beginning to show signs of crumbling, as global debt levels amounted to 241% of GDP by the end of 2019. However, once the deadly effects of the coronavirus began to spread around the world, leading to the shutdown of economies and imposition of nationwide restrictions, the financial consequences became evident, prompting central banks to swoop in with bountiful amounts of cash and extraordinary plans of absorbing corporate debt. However, the only means of supply for such copious amounts of spending is – drumroll – even more debt.

So as a result of debt and even more debt piling on top of an already-heaping pile of debt, global debt levels skyrocketed into the galaxy, rising to 252% of GDP, the largest quarterly spike on record according to Bank of International Settlements data. Of course, with such high debt levels, inflation targets need to somehow coincide in order to erase the deepening burden. Despite the astronomical debt that has been mounting as a result of the pandemic, central banks have thus far been sticking to the official 2% target rate, something that is certainly not going to cut it if the debt is to be eventually wiped out.

When many developed economies imposed complete or partial lockdowns back in March, it set off a spiral of economic contractions, propelling GDP growth downward by unprecedented levels. By the second quarter of 2020, debt accumulated by non-financial corporations and governments soared to record-breaking highs, which in turn will perpetuate into an even larger rise in the global leverage ratio.

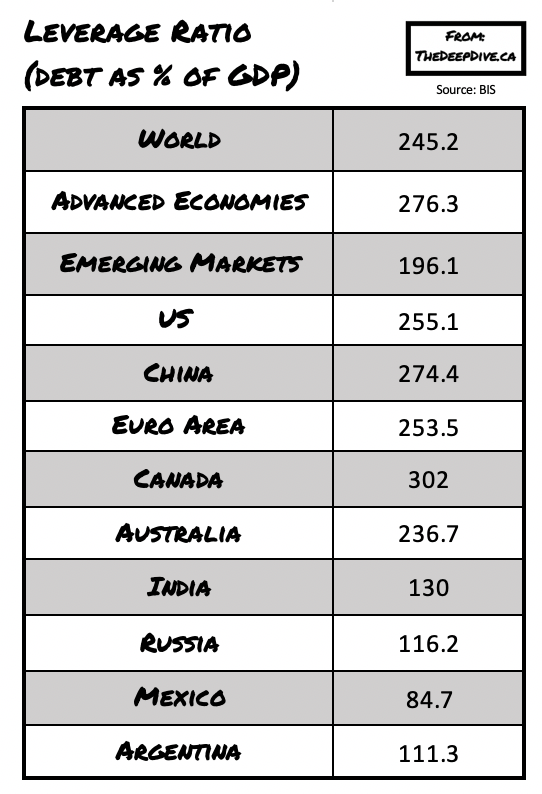

Although both developed and emerging countries have been subject to a leverage ratio spike as a result of the pandemic, there were already pre-existing conditions evident long before the outbreak. As a result, the OECD predicts that countries such as South Africa and India will likely see their GDP levels fall by 11.5% and 10.2% respectively which will further burden their leverage ratios. Nonetheless, as governments around the world turn to debt as a solution for existing debt, the likelihood of the entire financial system falling off the elemental chart increases with each passing day.

Information for this briefing was found via OECD, BIS, and Bank of America. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.