This author was not surprised by the asset write down included in the treatment of the fourth quarter balance sheet that we examined in the Project Greta post, having noted that the assets of MPX Bioceuticals and CBD for Life had been of questionable value since their acquisitions, and that Q4 would be their first examination by any kind of auditor.

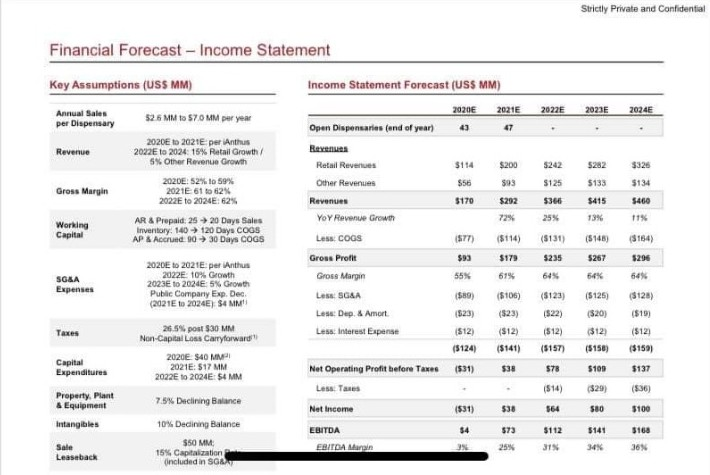

But the income projections in this document did surprise us.

After informing investors that it would release its audited year-end financials on April 6th, 2020, iAnthus moved their release to an indefinite date, instead announcing that it had defaulted on two different bond payments.

But the dramatic turn doesn’t appear to have soured management buyout group Saving Grace Ventures, who are very bullish on the growth prospects of a re-packaged iAnthus, projecting that such a company would have 43 dispensary locations opened by the end of 2020, and take in $170 million in revenues. That would represent a significant improvement from 2019.

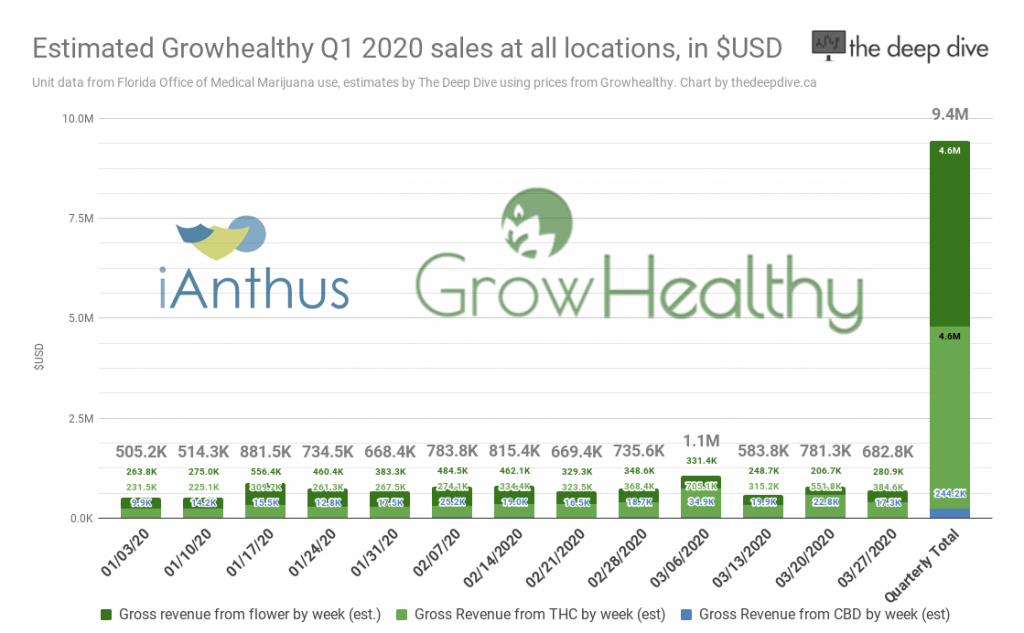

Without the year end statements, it’s hard to say how significant, so The Dive did some projections based on the publicly available sales data from the Florida Office of Medical Marijuana, who helpfully publishes sales data for the whole state, on a weekly basis (in .pdf format, which is less helpful).

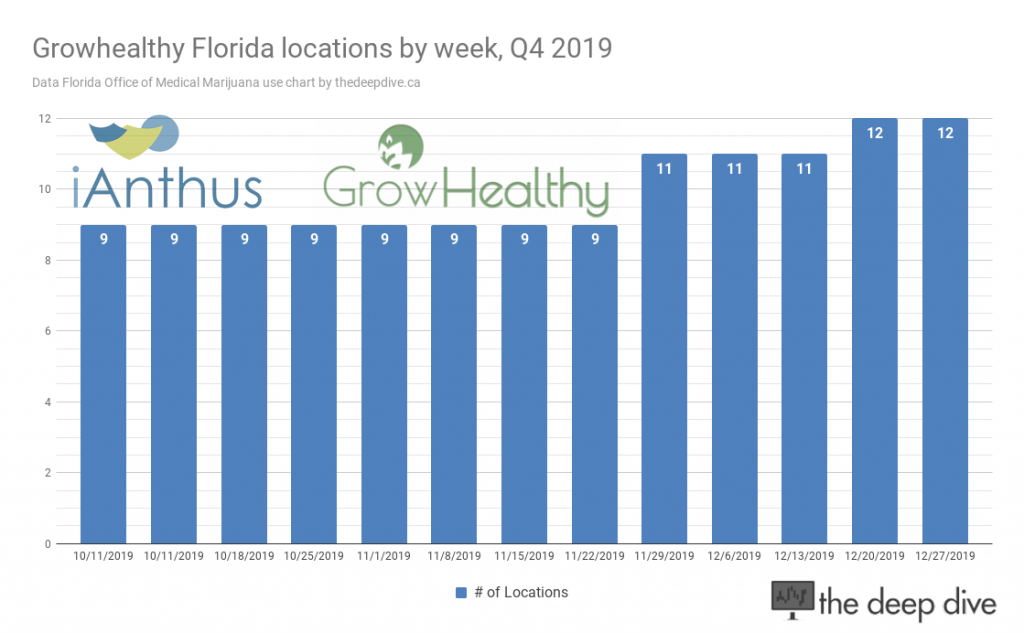

iAnthus’ Florida subsidiary Growhealthy grew its locations by 1/3 in Q4. The brand has since opened two more dispensaries, and has plans to open another five for a total of 19 Florida dispensaries.

Growhealthy does a brisk business that appears to be growing on a unit sales basis.

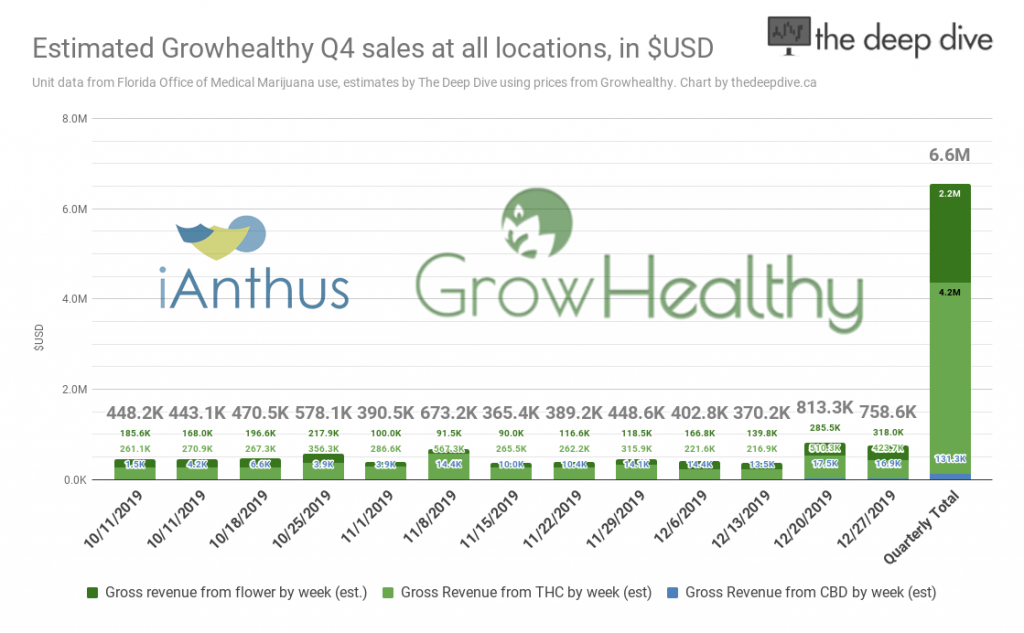

Using the pricing on Growhealthy’s delivery menu ($50 for an eighth ounce, $40 for a 300mg vape product), we estimate that the brand sold $6.6 million in Q4. That’s nearly half of the $13.2 million that iAnthus saw from the entire Eastern region (comprised of Florida, Maryland, Massachusetts, New York, New Jersey, Vermont, and its CBD business) in Q3, 2019. Growhealthy only had five locations in Florida at the beginning of Q3, nine at the end.

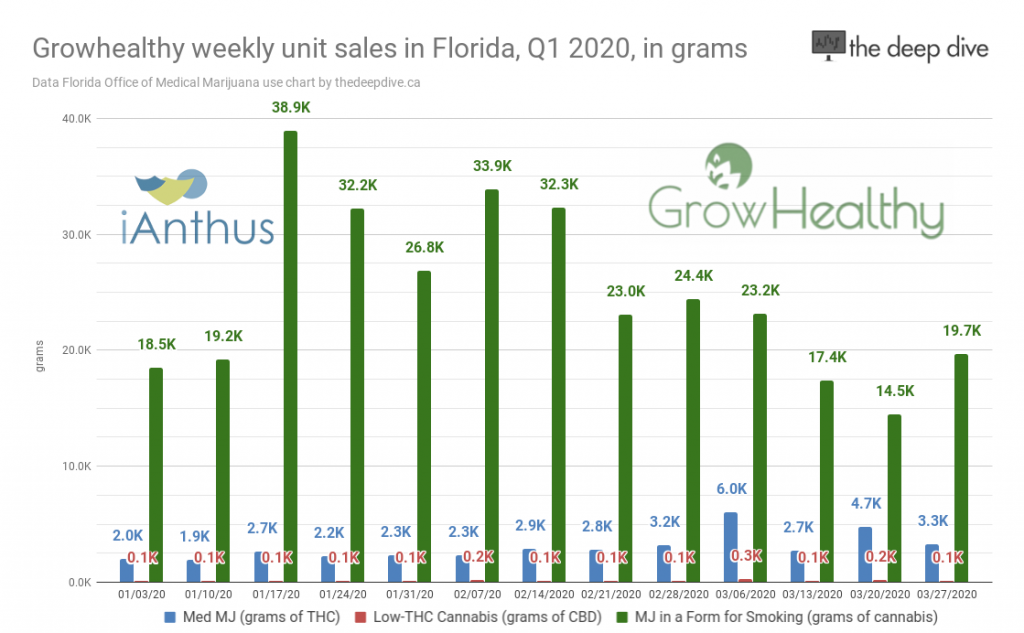

Since we’re coming up on the end of April 2020, the OMMU has data for Q1 2020 as well, and Growhealthy appears to have done even better in the 2020 opener, coronavirus or no coronavirus.

The 14 locations started off strong, but it appears that the novelty wore off a bit towards the end of the quarter. Despite the apparent slide, Growhealthy’s unit sales are up 43% over Q1, 2020, on a two location increase from twelve locations to fourteen locations (16.6%).

This makes our estimate look really good in dollar terms, but our estimates don’t account for sales or discounts that Growhealthy might have used to gain marketshare in the competitive Florida marijuana landscape.

With the Florida business apparently doing very well, we’ll be watching very closely to see where it ends up in the iAnthus reorganization that everyone knows is coming, but nobody knows how to read.

Our post on “Project Greta” examined the balance sheet of the iAnthus that would be following a management buyout and re-structuring that appears to have been conceived by Cormark Securities and certain elements of iAnthus’ management according to screenshots of “Strictly Private and Confidential,” documents obtained by The Deep Dive. It is not known where, if anywhere, they have been circulated.

Information for this briefing was found via Sedar and iAnthus Capital Holdings Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

Be cool if you could include the numbers up to May from OMMU. They have 3 records weeks in a row

Be cool to get the sales numbers up to May. They had record weeds in a row

can we get a revision on this. Curious how the last month would look

All this great analysis for a the private equity firm who will inevitably end up buying this pig.